How You Can Help Protect Yourself From Fraud

Here’s how you can help RBFCU keep your accounts safe

Whether it’s online, over the phone or in person, fraudsters are always trying to find new ways to attempt to access your personal information, and that’s why securing your information is a top priority at RBFCU. We constantly monitor potential threats to our online and mobile platforms to safeguard your accounts, but you — our members — are our first line of defense!

While your RBFCU accounts are already protected, here are four additional steps you can take to help secure your accounts and personal information from fraud:

Take advantage of the security tools in Online Banking

RBFCU offers several tools in your Online Banking account and in the RBFCU Mobile app to help keep your accounts safer. These tools are fast and easy to set up — just click on the tool below for more information and follow the prompts! Together with RBFCU’s robust security, they can help you protect your money and data.

Protect the devices you use to access your accounts

Protecting your money and information from fraudsters doesn’t stop with protecting your Online Banking account. The devices you use to access your accounts — your computer, smartphone, tablet and Wi-Fi network — should also be protected to ensure your information’s safety while online. Here are some tips for protecting your devices.

Learn about types of fraud

Knowledge is power when it comes to protecting yourself from fraud. While fraudsters are constantly looking for new ways to attempt to take your money, personal information or gain access to your accounts, most scams boil down to the same common methods.

By learning how to spot a scheme, you can avoid becoming a victim.

Monitor your identity with MemberSafe®

It’s more important than ever to actively monitor your identity and credit scores. For $5.95 per month per household, MemberSafe will help give you and your family3 peace of mind. You’ll also get:

- Up to $10,000 in fraud reimbursement coverage, as well as dedicated assistance from a specialized fraud case manager

- Timely alerts whenever changes affect your personal information or credit history

- Access to request an updated TransUnion credit report every 180 days

Tap & Go® with your RBFCU Mastercard®

RBFCU Mastercard debit and credit cards include contactless payment for greater security and more:

- Secure payments — your card never leaves your hand, reducing the risk of losing it or the theft of your data

- Encrypted purchases — just like when you insert your card into the card reader

- Faster checkouts — a simple tap is all it takes at millions of locations

- Cleaner alternative — only you touch your card at checkout

-

What other MFA options are available for my Online Banking account?

RBFCU also offers the following options when signing in to your Online Banking account on rbfcu.org or the RBFCU Mobile app:

- One-time passcode (OTP) by call or text

- Security question and answer

You can enable these options to prompt every time you sign in to your account.

To enable OTP for your account, sign in to your Online Banking account and visit the Multifactor Authentication page.

To enable OTP in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Profile Settings.”

- Select “Security Center.”

- Select “One-Time Passcode.”

- Turn the toggle switch next to “Enabled” to the “on” position.

Note: You must add a valid phone number or mobile number to your Online Banking account to use OTP.

To update your security question and answer, sign in to your Online Banking account and visit the Security Questions and Answers page.

To update in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Profile Settings.”

- Select “Security Center.”

- Select “Security Questions and Answers.”

- Follow the prompts to add or update your question and answer.

-

Can I change my username, password, or security questions and answers from the RBFCU Mobile app?

Yes. To change these security settings:

- Sign in to the RBFCU Mobile app.

- Tap the profile icon in the top-right corner of the screen.

- Tap “Profile Settings.”

- Tap “Security Center.”

- Select “Username,” “Password,” or “Security Questions and Answers” and follow the prompts to change the setting.

-

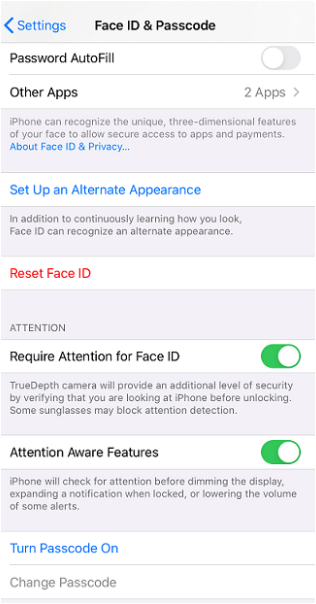

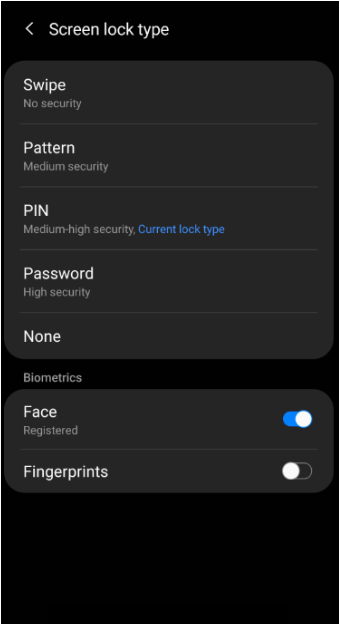

How do I set up fingerprint or face recognition on my device?

To turn on face and fingerprint (biometric) options on your device, open the “Settings” app, and follow the instructions provided with your device. To enable biometrics options, you’ll also need to set up a passcode lock, if you haven’t already. For additional help enabling biometrics, choose your option/device below:

After you’ve enabled biometrics:

- Open the RBFCU Mobile app®.

- Enter your username and password.

- Enable “Remember Me” by tapping the toggle switch under the “Password” field.

- Tap the “Sign In” button.

Once you enable Remember Me within the app, you will be prompted to sign in with your username and password at least once to verify. Your username and password will be captured, and you can sign in using a biometric option starting next time you sign in.

-

If I use biometrics (fingerprint or face) to sign in to the RBFCU Mobile app, will I have to enter my password?

No. If you’ve enabled “Remember Me” to use biometrics to sign in to the RBFCU Mobile app, you do not need to enter your password each time you sign in. To use this feature, you must enable biometrics on your device.

-

How do I enable a lock screen on my device?

To enable a lock screen on your device,

- Open Settings on your device, and set a passcode, finger-swipe pattern, face or fingerprint that will be used to access your device when it’s locked.

- Restart your device.

- When your device restarts, you’ll be prompted to put in your new authentication to unlock it.

If you need further assistance enabling a lock screen on your device, click here for Apple® instructions and click here for Android™ instructions.

Where to set up a lock screen on an Apple device:

Where to set up a lock screen on an Android device:

-

Why am I repeatedly being asked to reset my Online Banking password when I sign in?

Repeated password reset requests may display when trying to sign into your Online Banking profile if:

- Auto-filled passwords: Your internet browser is auto-filling an invalid or incorrect password.

- Bookmarks or favorites: Accessing the RBFCU website from an outdated bookmark or saved favorites link.

- Credential stuffing: Credential stuffing occurs when fraudsters attempt to sign in with random usernames and passwords in hopes they gain access to an account. In the case of credential stuffing, changing your username to a combination of letters, numbers and uncommon phrases is beneficial.

- Third-party websites or apps: If you’ve linked your RBFCU account to another website or app — for example, a personal finance or money transfer app — and recently changed your RBFCU Online Banking credentials, you'll need to update your information within that website or app.

1Enrolling in Alerts is free, but you may be charged for text messages by your mobile wireless provider. Alerts are a supplemental service and are not a replacement for responsible account review and management. You are responsible for any fees or charges incurred on your account whether you receive your Alerts or not.

2IRA statements, error resolution notices, tax statements or any additional financial documentation required by law will still be mailed until further notice.

RBFCU does not charge a fee for the RBFCU Mobile app, but you may be charged for data by your mobile wireless provider.

3MemberSafe® service is a personal identity theft protection service available to personal checking account owner(s), their joint account owners and their eligible family members. Family includes: Spouse, persons qualifying as domestic partner, and children under 25 years of age and parent(s) who are residents of the same household. Service is not available to a “signer” on the account who is not an account owner. Service is not available to businesses and their employees, clubs and/or churches and their members, schools and their employees/students. Please refer to the actual policies for terms, conditions, and exclusions of coverage.

Insurance products are not deposits; not NCUA insured; not an obligation of Randolph-Brooks Federal Credit Union (RBFCU); and not guaranteed by RBFCU or any affiliated entity.

Mastercard and Tap & Go are registered trademarks, and the circles design is a trademark, of Mastercard International Incorporated.

RBFCU and RBFCU employees will never initiate a phone call, email or text message to anyone — members or non-members — asking for your sign-in information, including usernames, passwords, security questions and answers, multifactor authentication (MFA) codes, MFA recovery codes and one-time passcodes (OTP), or other personal information, like account, credit card, debit card or Social Security numbers. Also, RBFCU employees will never need to sign in to your Online Banking account on your behalf. If someone contacts you claiming to be an RBFCU employee and asks you to approve a sign-in request for them, do not respond.

If you receive a suspicious phone call, email or text message, hang up, do not respond to the message, do not click any links, and do not open any attachments. Forward any suspicious emails and text message screenshots to abuse@rbfcu.org, then delete the message. If you believe your account, username or password has been compromised, you should immediately contact RBFCU at 210-945-3300 for assistance. Additionally, members should monitor their accounts regularly and report any suspicious transactions.