Banking Frequently Asked Questions

Your questions, answered

We’ve collected some of the most frequently asked questions about our banking products and services, and grouped them by topic to make it easier for you to access the information you need to make informed financial decisions.

Find FAQs by topic:

Really Free Checking | Freedom Debit Card |

Lost Debit Card | Overdraft Protection & Courtesy Pay | Round Up Program | Direct Deposit & ClickSWITCH | MemberSafe® | Savings |

Certificates | RBFCU Choice Money Market | RBFCU Classic Money Market | Individual Retirement Accounts (IRAs) | Online Banking & Mobile Banking | Sign-In, Email & Text Alerts | RBFCU Bill Pay® | Online Deposit & RBFCU Mobile Deposit® | Move Money |

Plaid | Multifactor Authentication (MFA) | STAR Program Help for Parents | STAR Program Help for Children | Paperless Preference (Electronic Statements & Documents) | RBFCU Mobile® App | Apple Pay |

Samsung Pay | Back to all FAQs

-

Are share accounts the same as deposit accounts?

Your RBFCU savings account represents your financial share in our organization as a member; that’s why it’s referred to as your “share account.” Because of NCUA Truth in Savings rules, RBFCU cannot describe a share account as a deposit account, but it is similar to a deposit account you would find at a bank.

-

Can I receive an Alert to see how much I've saved with Round Up each month?Yes.

-

How do I enroll in Round Up Alerts?To enroll in Round Up Alerts, sign in to Online Banking or the RBFCU Mobile® app. From the "View Services" menu, select "Set Alerts", then from the "Account and Loan Alerts" section, select your checking account from the dropdown menu. Toggle the radio button next to "Round Up Alerts", select your preferred Alerts notification method, then select "Save".

-

How do I find my routing number?

Your routing number is the first set of numbers printed on the bottom of your checking account checks, on the left side. If you do not have checks, you can find RBFCU’s routing number on rbfcu.org.

-

How do I know if I am eligible for Courtesy Pay?

To determine if you are eligible for Courtesy Pay:

Via computer: Visit the Courtesy Pay page in your Online Banking account and follow the prompts to enroll.

Via the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Select the desired account.

- Under the Account Number, review the account’s Courtesy Pay status.

- If you want to activate Courtesy Pay:

- Select the “Courtesy Pay” link under your Account Number.

- Select your account and Courtesy Pay option.

- Read the statement under “What you need to know about Courtesy Pay.”

- Select “Submit.”

-

How do I open a checking account from the RBFCU Mobile app?

To open a new checking account:

- Sign in to the RBFCU Mobile app.

- On the Account Summary page, tap “New Account” under “Deposit Accounts.”

- Verify your address, and tap “Let’s Get Started” to follow the self-service directions.

-

How does RBFCU pay checks and other transactions?

Checks and debits are presented against your Account by posting transactions according to a processing schedule. For ACH and Electronic Check processing, credit transactions are posted first throughout the day followed by debit transactions, regardless of the dollar amount of the item.

-

How many checks can be included in one deposit? Can multiple deposits be submitted each day?

Up to 999 checks can be included in one deposit and multiple deposits can be submitted as long as the accumulated dollar amount of the deposit(s) does not exceed the daily deposit limit.

-

How many times can I use Courtesy Pay in a day?

A Daily Fee Cap limit has been set at a maximum of five Courtesy Pay and/or Insufficient Funds Fees that a member can incur per day. If a member has not exhausted their specific Courtesy Pay dollar amount, RBFCU will cover additional charges without issuing a fee.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

How much is an overdraft fee?

We will charge you a $24 Courtesy Pay Fee each time we pay an overdraft for transactions over $5. For transactions that cause your balance to go into the negative $5 or less, Courtesy Pay fees will be waived. If you do not have Courtesy Pay on your account, we will charge you a $24 Insufficient Funds Fee for each item presented for payment over $5 that we return unpaid.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

How much time do I have to repay Courtesy Pay?

You have until 7 p.m. Central Time on the same business day to bring your account to current so a fee will not be assessed. You have 45 days to repay the transaction amount(s) plus fees incurred before your account is charged off.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

How often can I use Courtesy Pay?

There is a maximum limit of five Courtesy Pay and/or Insufficient Funds fees a member can incur per day. However, if intended abuse of the program is identified, Courtesy Pay can be revoked.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

I don't agree with the Courtesy Pay fee I was charged. What do I do?

In your Online Banking account, we offer additional detail regarding each Courtesy Pay transaction, including the balance in your account and the other pending transactions at the time the Courtesy Pay fee was assessed. Please take a moment to review this information for more detail on why a fee was assessed. If you feel a Courtesy Pay fee was incurred in error, please contact us at 210-945-3300.

You can change your Courtesy Pay selections (opt in or opt out) at any time using the following methods:

- Phone: Call our Member Services Center at 210-945-3300

- In-Person: Visit any branch

- Online: Visit the Courtesy Pay page in your Online Banking account to change your options.

- RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- On the Account Summary page, tap the desired account.

- Tap the “Courtesy Pay” link under your Account Number.

- Select your account and Courtesy Pay option.

- Tap “Submit.”

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

I have Courtesy Pay, but I want to remove it from my account. What do I do?

You can change your selections (opt in or opt out) using any of the following methods:

- Phone: Call our Member Services Center at 210-945-3300

- In-Person: Visit any branch

- Online: Visit the Courtesy Pay page in your Online Banking account to change your options.

- RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- On the Account Summary page, tap the desired account.

- Tap the “Courtesy Pay” link under your Account Number.

- Select your account and Courtesy Pay option.

- Tap “Submit.”

-

I need a debit or credit card today. Can I get a card made at an RBFCU branch?

No, RBFCU branches cannot make debit or credit cards. However, you can request a card at any RBFCU branch, and it will be mailed to your physical address on file, typically within three to five business days.

Although you may have to wait to receive a physical card, RBFCU offers instant digital access to your debit or credit card information through your Online Banking account or the RBFCU Mobile app. Choose “Manage Cards” from the menu, select your card, and then select “View Card Details.”

-

I opted out of Courtesy Pay but now I want it back. What do I do?

You can change your selections (opt in or opt out) using any of the following methods:

- By phone: Call our Member Services Center at 210-945-3300

- In person: Visit any branch

- On your computer: Visit the Courtesy Pay page in your Online Banking account and follow the prompts to change your Courtesy Pay options.

- In the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Tap the Checking Account on which Courtesy Pay is enabled.

- Tap on your Courtesy Pay status at the top of your Account Activity page.

- Follow the prompts to make changes to your Courtesy Pay status.

-

Is Courtesy Pay available to me when I opt in?

Courtesy Pay coverage is available as soon as you opt in.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

Under what circumstance would RBFCU not pay an Overdraft Item?

Overdrafts occur when you do not have available funds in your checking account and you have not enrolled in Overdraft Protection or Courtesy Pay. We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any type of transaction. If we do not authorize and pay for an overdraft, your transaction will be declined.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

What accounts can be used to receive Round Up proceeds?

The following RBFCU account types are eligible for members to select as the receiving account for the Round Up program:

- Basic Business Checking

- Business Money Market

- Business Savings

- Checking

- Choice Money Market

- Classic Money Market

- Elite Business Checking

- IOLTA Checking

- Non-Interest Checking

- Non-Interest Savings

- Organizational Checking

- Preferred Business Checking

- Primary Savings

- Savings

- Another member’s eligible RBFCU account. Note: The account owner of the sending account does not have to be an owner on the receiving account

Exception: IRA Savings accounts can not receive Round Up proceeds.

-

What if I do not have an email address when I apply for an account or a loan?

While an email address allows for an electronic transmission of product disclosures, RBFCU would instead mail any required documents to your mailing address on file.

-

What is a routing number?

A routing number is a unique 9-digit number assigned to a bank or credit union.

-

What is RBFCU's checking account routing number?

RBFCU's routing number is 314089681.

-

What is the Round Up program?

To help you grow your savings, the Round Up program rounds up eligible point-of-sale RBFCU Freedom Debit Card or Freedom Business Debit Card purchases to the next dollar and transfers the proceeds from your own checking account into an active RBFCU personal or business Savings or Checking account designated by you. As RBFCU Freedom Debit Card or Freedom Business Debit Card transactions are posted, the round up amount is calculated at the end of day and moved into the designated RBFCU account. This service is free for members. External accounts at other financial institutions are not eligible to receive Round Up proceeds.

Example: When you purchase a coffee for $5.57, the amount is rounded up to $6.00. $5.57 goes towards the purchase and the difference of $.43 is transferred into your designated RBFCU Round Up account.

For the transaction to round up, there must be sufficient funds in the Checking account. When funds are available to only cover the purchase, the transaction is completed without the round up amount. Round Up transactions are considered a transfer. They will appear on your Online Banking account and RBFCU statement.

You can enroll, opt out, or change the designated receiving account at any time by contacting an RBFCU representative by phone at 210-945-3300 or by starting a chat, or by visiting the Round Up page in your Online Banking account or the RBFCU Mobile app.

-

What should I do if my RBFCU Freedom Debit Card is lost or stolen?

You can report your lost or stolen RBFCU Freedom Debit Card by contacting us in one of the following ways:

- Online:

- Visit “Manage Cards,” after signing in to your Online Banking account

- Select your card

- Choose “Report a Lost or Stolen Card” and follow the prompts

- RBFCU Mobile app:

- Sign in to the app

- Tap “Manage Cards” in the bottom menu

- Select your card

- Choose “Report Lost or Stolen” and follow the prompts

- Phone: 210-945-3300

- Email: memberservices@rbfcu.org

You can also “Freeze” your card to ensure no transactions are made while you search for the card, or “Replace” your card. If your card is connected to any mobile payment services, be sure to remove the card as a payment option.

Your old debit card will be deactivated and we’ll send you a replacement debit card with a new card number.

If you have set up automatic payments directly with other merchants, you will need to contact them with your new card number and expiration date.

- Online:

-

When am I eligible to enroll in the Round Up program?

You are eligible to enroll in the Round Up program on the day that you join RBFCU and have an active Checking account linked to an RBFCU Freedom Debit Card.

-

When an account balance is zero or negative, do funds still round up?

No. When the account balance is zero, negative, or becomes zero after the round-up transaction, the application does not round to the next dollar amount.

-

When will I receive Round Up Alerts?If your eligible checking account was enrolled in Round Up the previous month, an Alert showing your Round Up savings from the previous month will be sent to you via your preferred notification method on the 1st of the following month.

-

Why do I have to answer these personal questions during the account opening/membership application process?

You may be asked to verify your identity by answering questions from public information sources, including questions about vehicles you or others in your household have owned, questions about addresses/places of residence, etc.

-

Why do I need a routing number?

In order to send and receive money from other financial institutions, banks and credit unions use a routing number to determine where money is supposed to go.

Routing numbers are commonly used for:

-

How do I activate my debit or credit card?

You can activate your new RBFCU Freedom Debit Card, World Cash Back Mastercard credit card or Premier Rate Mastercard credit card by one of the following ways:

- Online:

- Visit “Manage Cards,” after signing in to your Online Banking account

- Select your card

- Choose “Activate” and follow the prompts

- RBFCU Mobile app:

- Sign in to the app

- Tap “Manage Cards” in the bottom menu

- Select your card

- Choose “Activate” and follow the prompts

- Phone:

- RBFCU Freedom Debit cardholders: 1-800-992-3808

- World Cash Back credit card cardholders: 1-888-999-4355

- Premier Rate and Business Select cardholders: 1-888-999-4336

Watch this video to learn how to activate and manage your cards using the Manage Cards feature in your Online Banking account:

After you activate your card, you can manage your account through Manage Cards in your Online Banking account or the RBFCU Mobile app.

- Online:

-

How do I use Manage Cards in the RBFCU Mobile app?

To use Manage Cards in the RBFCU Mobile app, tap “Manage Cards” in the bottom navigation. Select the credit or debit card you’d like to manage, and you’ll be given the options to:

- Activate a new card

- Select your card’s PIN

- View details for your card, like your full account number, expiration date and security code

- Freeze your card from making transactions if it is misplaced

- Report your card lost or stolen, which will issue a new card/number

- Request a replacement card

- Set spend controls and Alerts for your card

- Add your card to your Apple Wallet

Watch this video to learn how to activate and manage your cards using the Manage Cards feature in your Online Banking account:

-

How does RBFCU pay checks and other transactions?

Checks and debits are presented against your Account by posting transactions according to a processing schedule. For ACH and Electronic Check processing, credit transactions are posted first throughout the day followed by debit transactions, regardless of the dollar amount of the item.

-

I need a debit or credit card today. Can I get a card made at an RBFCU branch?

No, RBFCU branches cannot make debit or credit cards. However, you can request a card at any RBFCU branch, and it will be mailed to your physical address on file, typically within three to five business days.

Although you may have to wait to receive a physical card, RBFCU offers instant digital access to your debit or credit card information through your Online Banking account or the RBFCU Mobile app. Choose “Manage Cards” from the menu, select your card, and then select “View Card Details.”

-

If my physical RBFCU card is lost or was stolen and I have Apple Pay or Samsung Pay, what do I do?

You can report your lost or stolen card by contacting us in one of the following ways:

- Online: Sign in to your Online Banking account to report your card lost or stolen in Manage Cards.

- RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Tap “Manage Cards.”

- Select your card.

- Select the appropriate option (e.g., “Report Lost or Stolen,” “Freeze” or “Replace”).

- Verify the information for accuracy, and click “Submit.”

- If your card is connected to a mobile wallet like Samsung Pay or Apple Pay, remove the card from the devices.

- Phone: 210-945-3300

- Email: memberservices@rbfcu.org

-

What should I do if my RBFCU Freedom Debit Card is lost or stolen?

You can report your lost or stolen RBFCU Freedom Debit Card by contacting us in one of the following ways:

- Online:

- Visit “Manage Cards,” after signing in to your Online Banking account

- Select your card

- Choose “Report a Lost or Stolen Card” and follow the prompts

- RBFCU Mobile app:

- Sign in to the app

- Tap “Manage Cards” in the bottom menu

- Select your card

- Choose “Report Lost or Stolen” and follow the prompts

- Phone: 210-945-3300

- Email: memberservices@rbfcu.org

You can also “Freeze” your card to ensure no transactions are made while you search for the card, or “Replace” your card. If your card is connected to any mobile payment services, be sure to remove the card as a payment option.

Your old debit card will be deactivated and we’ll send you a replacement debit card with a new card number.

If you have set up automatic payments directly with other merchants, you will need to contact them with your new card number and expiration date.

- Online:

-

If my physical RBFCU card is lost or was stolen and I have Apple Pay or Samsung Pay, what do I do?

You can report your lost or stolen card by contacting us in one of the following ways:

- Online: Sign in to your Online Banking account to report your card lost or stolen in Manage Cards.

- RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Tap “Manage Cards.”

- Select your card.

- Select the appropriate option (e.g., “Report Lost or Stolen,” “Freeze” or “Replace”).

- Verify the information for accuracy, and click “Submit.”

- If your card is connected to a mobile wallet like Samsung Pay or Apple Pay, remove the card from the devices.

- Phone: 210-945-3300

- Email: memberservices@rbfcu.org

-

What should I do if my RBFCU Freedom Debit Card is lost or stolen?

You can report your lost or stolen RBFCU Freedom Debit Card by contacting us in one of the following ways:

- Online:

- Visit “Manage Cards,” after signing in to your Online Banking account

- Select your card

- Choose “Report a Lost or Stolen Card” and follow the prompts

- RBFCU Mobile app:

- Sign in to the app

- Tap “Manage Cards” in the bottom menu

- Select your card

- Choose “Report Lost or Stolen” and follow the prompts

- Phone: 210-945-3300

- Email: memberservices@rbfcu.org

You can also “Freeze” your card to ensure no transactions are made while you search for the card, or “Replace” your card. If your card is connected to any mobile payment services, be sure to remove the card as a payment option.

Your old debit card will be deactivated and we’ll send you a replacement debit card with a new card number.

If you have set up automatic payments directly with other merchants, you will need to contact them with your new card number and expiration date.

- Online:

-

How do I know if I am eligible for Courtesy Pay?

To determine if you are eligible for Courtesy Pay:

Via computer: Visit the Courtesy Pay page in your Online Banking account and follow the prompts to enroll.

Via the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Select the desired account.

- Under the Account Number, review the account’s Courtesy Pay status.

- If you want to activate Courtesy Pay:

- Select the “Courtesy Pay” link under your Account Number.

- Select your account and Courtesy Pay option.

- Read the statement under “What you need to know about Courtesy Pay.”

- Select “Submit.”

-

How many times can I use Courtesy Pay in a day?

A Daily Fee Cap limit has been set at a maximum of five Courtesy Pay and/or Insufficient Funds Fees that a member can incur per day. If a member has not exhausted their specific Courtesy Pay dollar amount, RBFCU will cover additional charges without issuing a fee.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

How much is an overdraft fee?

We will charge you a $24 Courtesy Pay Fee each time we pay an overdraft for transactions over $5. For transactions that cause your balance to go into the negative $5 or less, Courtesy Pay fees will be waived. If you do not have Courtesy Pay on your account, we will charge you a $24 Insufficient Funds Fee for each item presented for payment over $5 that we return unpaid.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

How much time do I have to repay Courtesy Pay?

You have until 7 p.m. Central Time on the same business day to bring your account to current so a fee will not be assessed. You have 45 days to repay the transaction amount(s) plus fees incurred before your account is charged off.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

How often can I use Courtesy Pay?

There is a maximum limit of five Courtesy Pay and/or Insufficient Funds fees a member can incur per day. However, if intended abuse of the program is identified, Courtesy Pay can be revoked.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

I don't agree with the Courtesy Pay fee I was charged. What do I do?

In your Online Banking account, we offer additional detail regarding each Courtesy Pay transaction, including the balance in your account and the other pending transactions at the time the Courtesy Pay fee was assessed. Please take a moment to review this information for more detail on why a fee was assessed. If you feel a Courtesy Pay fee was incurred in error, please contact us at 210-945-3300.

You can change your Courtesy Pay selections (opt in or opt out) at any time using the following methods:

- Phone: Call our Member Services Center at 210-945-3300

- In-Person: Visit any branch

- Online: Visit the Courtesy Pay page in your Online Banking account to change your options.

- RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- On the Account Summary page, tap the desired account.

- Tap the “Courtesy Pay” link under your Account Number.

- Select your account and Courtesy Pay option.

- Tap “Submit.”

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

I have Courtesy Pay, but I want to remove it from my account. What do I do?

You can change your selections (opt in or opt out) using any of the following methods:

- Phone: Call our Member Services Center at 210-945-3300

- In-Person: Visit any branch

- Online: Visit the Courtesy Pay page in your Online Banking account to change your options.

- RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- On the Account Summary page, tap the desired account.

- Tap the “Courtesy Pay” link under your Account Number.

- Select your account and Courtesy Pay option.

- Tap “Submit.”

-

I opted out of Courtesy Pay but now I want it back. What do I do?

You can change your selections (opt in or opt out) using any of the following methods:

- By phone: Call our Member Services Center at 210-945-3300

- In person: Visit any branch

- On your computer: Visit the Courtesy Pay page in your Online Banking account and follow the prompts to change your Courtesy Pay options.

- In the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Tap the Checking Account on which Courtesy Pay is enabled.

- Tap on your Courtesy Pay status at the top of your Account Activity page.

- Follow the prompts to make changes to your Courtesy Pay status.

-

Is Courtesy Pay available to me when I opt in?

Courtesy Pay coverage is available as soon as you opt in.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

Under what circumstance would RBFCU not pay an Overdraft Item?

Overdrafts occur when you do not have available funds in your checking account and you have not enrolled in Overdraft Protection or Courtesy Pay. We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any type of transaction. If we do not authorize and pay for an overdraft, your transaction will be declined.

For more information, read “What You Need to Know About Overdrafts and Overdraft Fees.”

-

Can I receive an Alert to see how much I've saved with Round Up each month?Yes.

-

How do I enroll in Round Up Alerts?To enroll in Round Up Alerts, sign in to Online Banking or the RBFCU Mobile® app. From the "View Services" menu, select "Set Alerts", then from the "Account and Loan Alerts" section, select your checking account from the dropdown menu. Toggle the radio button next to "Round Up Alerts", select your preferred Alerts notification method, then select "Save".

-

When will I receive Round Up Alerts?If your eligible checking account was enrolled in Round Up the previous month, an Alert showing your Round Up savings from the previous month will be sent to you via your preferred notification method on the 1st of the following month.

-

When an account balance is zero or negative, do funds still round up?

No. When the account balance is zero, negative, or becomes zero after the round-up transaction, the application does not round to the next dollar amount.

-

When am I eligible to enroll in the Round Up program?

You are eligible to enroll in the Round Up program on the day that you join RBFCU and have an active Checking account linked to an RBFCU Freedom Debit Card.

-

What is the Round Up program?

To help you grow your savings, the Round Up program rounds up eligible point-of-sale RBFCU Freedom Debit Card or Freedom Business Debit Card purchases to the next dollar and transfers the proceeds from your own checking account into an active RBFCU personal or business Savings or Checking account designated by you. As RBFCU Freedom Debit Card or Freedom Business Debit Card transactions are posted, the round up amount is calculated at the end of day and moved into the designated RBFCU account. This service is free for members. External accounts at other financial institutions are not eligible to receive Round Up proceeds.

Example: When you purchase a coffee for $5.57, the amount is rounded up to $6.00. $5.57 goes towards the purchase and the difference of $.43 is transferred into your designated RBFCU Round Up account.

For the transaction to round up, there must be sufficient funds in the Checking account. When funds are available to only cover the purchase, the transaction is completed without the round up amount. Round Up transactions are considered a transfer. They will appear on your Online Banking account and RBFCU statement.

You can enroll, opt out, or change the designated receiving account at any time by contacting an RBFCU representative by phone at 210-945-3300 or by starting a chat, or by visiting the Round Up page in your Online Banking account or the RBFCU Mobile app.

-

What accounts can be used to receive Round Up proceeds?

The following RBFCU account types are eligible for members to select as the receiving account for the Round Up program:

- Basic Business Checking

- Business Money Market

- Business Savings

- Checking

- Choice Money Market

- Classic Money Market

- Elite Business Checking

- IOLTA Checking

- Non-Interest Checking

- Non-Interest Savings

- Organizational Checking

- Preferred Business Checking

- Primary Savings

- Savings

- Another member’s eligible RBFCU account. Note: The account owner of the sending account does not have to be an owner on the receiving account

Exception: IRA Savings accounts can not receive Round Up proceeds.

-

How do I find my routing number?

Your routing number is the first set of numbers printed on the bottom of your checking account checks, on the left side. If you do not have checks, you can find RBFCU’s routing number on rbfcu.org.

-

How does ClickSWITCH work?

ClickSWITCH takes the hassle out of switching your direct deposits and automated payments to your account.

Whether you provide your employer or bill payment information to ClickSWITCH through your RBFCU Online Banking account or have an RBFCU representative enter the information for you, ClickSWITCH will work on contacting the billers to switch your payments to your RBFCU account.

-

How long does it take for a ClickSWITCH request to reflect on my account?

When using ClickSWITCH, it can take one to two billing cycles for the deposit or bill payment to show on your account. This time frame depends on the company receiving the switch. If a submitted switch does not appear on your account within one to two billing cycles, contact the company the payment or deposit originates from.

-

What is a routing number?

A routing number is a unique 9-digit number assigned to a bank or credit union.

-

What is ClickSWITCH?

ClickSWITCH is an automated account-switching tool that makes it easy to quickly and securely switch your recurring direct deposits and automatic payments from another financial institution account to your RBFCU account.

-

What is RBFCU's checking account routing number?

RBFCU's routing number is 314089681.

-

Who do I contact for help enrolling in ClickSWITCH?

For help enrolling in ClickSWITCH for your direct deposit:

- Online: Sign in to your Online Banking account at rbfcu.org or via the RBFCU Mobile® app, then select ClickSWITCH from the View Services menu on your Account Summary page

- Phone: 210-945-3300

- In person: Visit any branch

-

Why do I need a routing number?

In order to send and receive money from other financial institutions, banks and credit unions use a routing number to determine where money is supposed to go.

Routing numbers are commonly used for:

-

Are share accounts the same as deposit accounts?

Your RBFCU savings account represents your financial share in our organization as a member; that’s why it’s referred to as your “share account.” Because of NCUA Truth in Savings rules, RBFCU cannot describe a share account as a deposit account, but it is similar to a deposit account you would find at a bank.

-

Are transactions limited for Money Market accounts?

You are limited to six (6) withdrawals and/or outgoing transfers per Money Market (either RBFCU Classic or RBFCU Choice) account, per month. Transactions subject to this limitation include withdrawals and/or outgoing transfers (when completed in person, over the phone, electronically or preauthorized). For each transaction exceeding six (6), an Excessive Transaction Fee will be charged. However, you are not limited on deposits. Please refer to the Truth in Savings Fee Schedule for additional information.

-

Can I write checks from my Money Market account?

No. RBFCU Money Market accounts do not offer check-writing privileges.

-

How can I close my RBFCU Choice Money Market?

A Choice Money Market can be closed on all channels with the exception of the RBFCU Mobile app.

-

How can I compare the dividends I could earn in the RBFCU Choice vs. the RBFCU Classic to help determine which money market account would best benefit me?

The Money Market Comparison Calculator is available on rbfcu.org as a tool to estimate interest earned with both products.

-

How can I open an RBFCU Choice Money Market?

A Choice Money Market account may be opened online, through the RBFCU Mobile app, by calling our Member Service Center at 210-945-3300, or at any RBFCU branch. Minimum opening balance is $2,500.

-

How do I make withdrawals from a Money Market account?

Withdrawals and transfers may be made through Online Banking, the RBFCU Mobile app, by calling our Member Service Center at 210-945-3300, or at any RBFCU branch.

-

How is a Money Market different from a savings account?

A Money Market account typically earns a higher yield than a traditional savings account. Money Market accounts also usually require a higher minimum balance.

-

How is this different from an RBFCU Classic Money Market?

With the Classic Money Market, you earn a flat dividend rate on your total balance. A Choice Money Market utilizes blended dividend rates, which apply higher earnings rates to lower balances. As your balance increases, previous rates are retained and incorporated into your overall earnings. See rate schedule above.

-

How many checks can be included in one deposit? Can multiple deposits be submitted each day?

Up to 999 checks can be included in one deposit and multiple deposits can be submitted as long as the accumulated dollar amount of the deposit(s) does not exceed the daily deposit limit.

-

How many RBFCU Choice Money Market accounts can I open?

Only one Choice Money Market account, per tax-reported owner, may be opened.

-

How will I know if I've used my six transfers for the month?

- Sign in to your Online Banking account.

- Under the “View Accounts” tab, select your Money Market account.

- Under “Your Summary/Account Activity,” review the information listed to the left of your “Available Balance.”

-

I already have an RBFCU Classic Money Market. Can I switch it to an RBFCU Choice Money Market?

Yes. You may close your Classic Money Market account and open a Choice Money Market account. However, only one Choice Money Market is available per tax-reported owner. There is not a limit to the number of Classic Money Market accounts you can own. This account will not be available to businesses (EINs).

-

Is an RBFCU Money Market an investment product? Can it lose value?

An RBFCU Money Market account is not an investment product, nor will your funds be publicly traded. Your account is federally insured up to certain limits by the NCUA and will not lose value.

-

Is there a monthly fee for an RBFCU Choice Money Market?

No. There is no monthly fee.

-

What are the benefits of the RBFCU Choice Money Market?

- Minimum balance: $2,500

- Blended rate structure, resulting in the highest earnings on balances under $10,000. As your balance increases, previous rates are retained and incorporated into your overall earnings.

- Enjoy the features of a Classic Money Market, including accessibility to funds, no monthly service fees and dividends paid monthly.

-

What does blended rate mean?

A blended rate is an interest rate that represents the combination of multiple rates. Our RBFCU Choice Money Market calculator will show how different tiers of your balance earn a separate rate and what your overall rate will be based on the balance you provide.

-

What happens if I exceed six transfers from my Money Market account per month?

An Excessive Transaction Fee will be charged for each withdrawal and/or outgoing transfer exceeding six (6) per month (when completed in person, over the phone, electronically or preauthorized). Please refer to the Truth in Savings Fee Schedule for additional information.

-

What happens if my Money Market balance falls below $2,500?

You do not have to close your Money Market account; however, if your balance falls below $2,500, the account will automatically revert to the savings account rate at that time, by the end of the business day. The account name will remain an “RBFCU Money Market.”

If a transaction, payment or transfer presented electronically or over the phone to an external merchant causes your Available Balance to fall below the minimum requirement of $2,500, the transaction will be rejected and returned unpaid. For complete details, please review our Truth in Savings Account Disclosures.

When your balance is brought back up to $2,500, you will earn the RBFCU Money Market rate again.

-

What if I do not have an email address when I apply for an account or a loan?

While an email address allows for an electronic transmission of product disclosures, RBFCU would instead mail any required documents to your mailing address on file.

-

What is an RBFCU Choice Money Market?

The RBFCU Choice Money Market account is another savings account option that utilizes blended dividend rates, which apply higher earnings rates to lower balances. As your balance increases, previous rates are retained and incorporated into your overall earnings.

-

What is the minimum balance required for an RBFCU Choice Money Market?

The minimum balance to open an RBFCU Choice Money Market account is $2,500.

-

What's the difference between the dividend rate and APY?

APY means Annual Percentage Yield. This refers to how much money you earn on a deposit over a year, taking into account compounding interest. The dividend rate is the declared annual dividend rate paid on an account, which does not reflect compounding.

-

When are dividends paid out on Money Market accounts?

Dividends are paid out monthly.

-

Will the RBFCU Classic Money Market still be available?

Yes. You will still be able to open and maintain the Classic Money Market account.

-

Are share accounts the same as deposit accounts?

Your RBFCU savings account represents your financial share in our organization as a member; that’s why it’s referred to as your “share account.” Because of NCUA Truth in Savings rules, RBFCU cannot describe a share account as a deposit account, but it is similar to a deposit account you would find at a bank.

-

Can a certificate or SuperSaver Certificate have joint owners?

Yes. Certificates and SuperSaver Certificates can have joint owners as long as all of the joint owners are members of RBFCU.

-

Can I lose money with a certificate account?

No. Certificates are low-risk ways to protect your money and earn a higher rate than regular savings or checking accounts. However, certificate accounts closed before their maturity date are subject to a penalty for early withdrawal.

For more information, review the early withdrawal penalties in the Truth in Savings Account Disclosures.

-

Can I pay off a consumer loan with a certificate?

Yes. You can request to close your certificate and use the proceeds to pay off a consumer loan. You must close your certificate prior to paying off the loan to assess appropriate certificate penalties when applicable.

-

Can I use a certificate or SuperSaver Certificate as collateral for a loan?

Yes. You can use a certificate or SuperSaver Certificate as collateral for a loan. Only one loan is allowed per certificate. The loan term cannot exceed the certificate's maturity date.

You cannot use IRA certificates as collateral for a loan.

For more information, visit our Personal Loans page.

-

Is a Certificate the same as a CD?

Share Certificates and Certificates of Deposit, or CDs, are two names for similar long-term savings accounts, but there are some differences.

Credit unions, like RBFCU, may offer Share Certificates, which are dividend-bearing accounts. Savings placed in Share Certificates are equity investments, and the returns earned on these accounts are dividends. Because of NCUA Truth in Savings rules, you may also see credit unions call these accounts “Share Certificate Accounts,” “Certificate Accounts” or just “Certificates.”

Banks may offer CDs, which are interest-bearing accounts.

-

Is there a penalty for an early withdrawal on an IRA certificate?

Yes. If funds are being withdrawn from an IRA certificate, IRS taxes and penalties may apply.

For more information, review the early withdrawal penalties in the Truth in Savings Account Disclosures.

-

Is there a penalty for early closure of a certificate or SuperSaver certificate?

Closing a certificate or SuperSaver certificate early (e.g., before the maturity date) may incur penalties. If funds are withdrawn from an IRA Share Certificate or IRA SuperSaver Certificate, IRS taxes and penalties may apply.

For more information, review the early withdrawal penalties in the Truth in Savings Account Disclosures.

-

What are the benefits of a Share Certificate account?

- Automatic renewal on maturity

- Dividends paid monthly

- Dividends can be:

- Paid to an RBFCU savings, checking or Money Market account

- Compounded within the certificate

- Dividend rate locked in at purchase and through maturity

-

What is a Share Certificate account?

A Share Certificate is a certificate issued by a credit union. It represents a deposit that is made for a certain period of time that earns specified dividends over that period. A Share Certificate is a term share account with a maturity of at least 6 months.

A $1,000 minimum is required to open a Share Certificate account and earn the stated APY.

-

What is a SuperSaver Certificate?

The SuperSaver Certificate is an 18-month Share Certificate or an 18-month IRA certificate that is offered at a higher dividend rate than a regular Share Certificate.

Details:

- $1,000 balance limit required to open account and earn stated APY

- Dividends are paid monthly

- Dividends can be compounded back to the certificate or paid into an RBFCU savings, checking or Money Market account

- Higher dividend rate

- Dividend rate is locked in at purchase or maturity dates

- No limit to how many SuperSaver Certificates you can have

- No monthly service fees

SuperSaver 18-month Certificate is available for consumer accounts and does not apply to business accounts.

-

What is the grace period for a certificate?

The grace period for a certificate is 10 days. After the certificate matures, you can choose to renew it or not renew it for the balance and term, without penalty.

-

What products are available for certificate loans?

The only product available for certificate loans is Credit Insurance.

-

When are my funds available from my certificate loan?

After finalizing the loan, the funds are available immediately.

-

Are share accounts the same as deposit accounts?

Your RBFCU savings account represents your financial share in our organization as a member; that’s why it’s referred to as your “share account.” Because of NCUA Truth in Savings rules, RBFCU cannot describe a share account as a deposit account, but it is similar to a deposit account you would find at a bank.

-

Are transactions limited for Money Market accounts?

You are limited to six (6) withdrawals and/or outgoing transfers per Money Market (either RBFCU Classic or RBFCU Choice) account, per month. Transactions subject to this limitation include withdrawals and/or outgoing transfers (when completed in person, over the phone, electronically or preauthorized). For each transaction exceeding six (6), an Excessive Transaction Fee will be charged. However, you are not limited on deposits. Please refer to the Truth in Savings Fee Schedule for additional information.

-

Can I write checks from my Money Market account?

No. RBFCU Money Market accounts do not offer check-writing privileges.

-

How can I close my RBFCU Choice Money Market?

A Choice Money Market can be closed on all channels with the exception of the RBFCU Mobile app.

-

How can I compare the dividends I could earn in the RBFCU Choice vs. the RBFCU Classic to help determine which money market account would best benefit me?

The Money Market Comparison Calculator is available on rbfcu.org as a tool to estimate interest earned with both products.

-

How can I open an RBFCU Choice Money Market?

A Choice Money Market account may be opened online, through the RBFCU Mobile app, by calling our Member Service Center at 210-945-3300, or at any RBFCU branch. Minimum opening balance is $2,500.

-

How do I make withdrawals from a Money Market account?

Withdrawals and transfers may be made through Online Banking, the RBFCU Mobile app, by calling our Member Service Center at 210-945-3300, or at any RBFCU branch.

-

How is a Money Market different from a savings account?

A Money Market account typically earns a higher yield than a traditional savings account. Money Market accounts also usually require a higher minimum balance.

-

How is this different from an RBFCU Classic Money Market?

With the Classic Money Market, you earn a flat dividend rate on your total balance. A Choice Money Market utilizes blended dividend rates, which apply higher earnings rates to lower balances. As your balance increases, previous rates are retained and incorporated into your overall earnings. See rate schedule above.

-

How many RBFCU Choice Money Market accounts can I open?

Only one Choice Money Market account, per tax-reported owner, may be opened.

-

How will I know if I've used my six transfers for the month?

- Sign in to your Online Banking account.

- Under the “View Accounts” tab, select your Money Market account.

- Under “Your Summary/Account Activity,” review the information listed to the left of your “Available Balance.”

-

I already have an RBFCU Classic Money Market. Can I switch it to an RBFCU Choice Money Market?

Yes. You may close your Classic Money Market account and open a Choice Money Market account. However, only one Choice Money Market is available per tax-reported owner. There is not a limit to the number of Classic Money Market accounts you can own. This account will not be available to businesses (EINs).

-

Is an RBFCU Money Market an investment product? Can it lose value?

An RBFCU Money Market account is not an investment product, nor will your funds be publicly traded. Your account is federally insured up to certain limits by the NCUA and will not lose value.

-

Is there a monthly fee for an RBFCU Choice Money Market?

No. There is no monthly fee.

-

What are the benefits of the RBFCU Choice Money Market?

- Minimum balance: $2,500

- Blended rate structure, resulting in the highest earnings on balances under $10,000. As your balance increases, previous rates are retained and incorporated into your overall earnings.

- Enjoy the features of a Classic Money Market, including accessibility to funds, no monthly service fees and dividends paid monthly.

-

What does blended rate mean?

A blended rate is an interest rate that represents the combination of multiple rates. Our RBFCU Choice Money Market calculator will show how different tiers of your balance earn a separate rate and what your overall rate will be based on the balance you provide.

-

What happens if I exceed six transfers from my Money Market account per month?

An Excessive Transaction Fee will be charged for each withdrawal and/or outgoing transfer exceeding six (6) per month (when completed in person, over the phone, electronically or preauthorized). Please refer to the Truth in Savings Fee Schedule for additional information.

-

What happens if my Money Market balance falls below $2,500?

You do not have to close your Money Market account; however, if your balance falls below $2,500, the account will automatically revert to the savings account rate at that time, by the end of the business day. The account name will remain an “RBFCU Money Market.”

If a transaction, payment or transfer presented electronically or over the phone to an external merchant causes your Available Balance to fall below the minimum requirement of $2,500, the transaction will be rejected and returned unpaid. For complete details, please review our Truth in Savings Account Disclosures.

When your balance is brought back up to $2,500, you will earn the RBFCU Money Market rate again.

-

What is an RBFCU Choice Money Market?

The RBFCU Choice Money Market account is another savings account option that utilizes blended dividend rates, which apply higher earnings rates to lower balances. As your balance increases, previous rates are retained and incorporated into your overall earnings.

-

What is the minimum balance required for an RBFCU Choice Money Market?

The minimum balance to open an RBFCU Choice Money Market account is $2,500.

-

What's the difference between the dividend rate and APY?

APY means Annual Percentage Yield. This refers to how much money you earn on a deposit over a year, taking into account compounding interest. The dividend rate is the declared annual dividend rate paid on an account, which does not reflect compounding.

-

When are dividends paid out on Money Market accounts?

Dividends are paid out monthly.

-

Will the RBFCU Classic Money Market still be available?

Yes. You will still be able to open and maintain the Classic Money Market account.

-

Are share accounts the same as deposit accounts?

Your RBFCU savings account represents your financial share in our organization as a member; that’s why it’s referred to as your “share account.” Because of NCUA Truth in Savings rules, RBFCU cannot describe a share account as a deposit account, but it is similar to a deposit account you would find at a bank.

-

Are transactions limited for Money Market accounts?

You are limited to six (6) withdrawals and/or outgoing transfers per Money Market (either RBFCU Classic or RBFCU Choice) account, per month. Transactions subject to this limitation include withdrawals and/or outgoing transfers (when completed in person, over the phone, electronically or preauthorized). For each transaction exceeding six (6), an Excessive Transaction Fee will be charged. However, you are not limited on deposits. Please refer to the Truth in Savings Fee Schedule for additional information.

-

Can I write checks from my Money Market account?

No. RBFCU Money Market accounts do not offer check-writing privileges.

-

How can I compare the dividends I could earn in the RBFCU Choice vs. the RBFCU Classic to help determine which money market account would best benefit me?

The Money Market Comparison Calculator is available on rbfcu.org as a tool to estimate interest earned with both products.

-

How do I make withdrawals from a Money Market account?

Withdrawals and transfers may be made through Online Banking, the RBFCU Mobile app, by calling our Member Service Center at 210-945-3300, or at any RBFCU branch.

-

How is a Money Market different from a savings account?

A Money Market account typically earns a higher yield than a traditional savings account. Money Market accounts also usually require a higher minimum balance.

-

How will I know if I've used my six transfers for the month?

- Sign in to your Online Banking account.

- Under the “View Accounts” tab, select your Money Market account.

- Under “Your Summary/Account Activity,” review the information listed to the left of your “Available Balance.”

-

I already have an RBFCU Classic Money Market. Can I switch it to an RBFCU Choice Money Market?

Yes. You may close your Classic Money Market account and open a Choice Money Market account. However, only one Choice Money Market is available per tax-reported owner. There is not a limit to the number of Classic Money Market accounts you can own. This account will not be available to businesses (EINs).

-

Is an RBFCU Money Market an investment product? Can it lose value?

An RBFCU Money Market account is not an investment product, nor will your funds be publicly traded. Your account is federally insured up to certain limits by the NCUA and will not lose value.

-

What happens if I exceed six transfers from my Money Market account per month?

An Excessive Transaction Fee will be charged for each withdrawal and/or outgoing transfer exceeding six (6) per month (when completed in person, over the phone, electronically or preauthorized). Please refer to the Truth in Savings Fee Schedule for additional information.

-

What happens if my Money Market balance falls below $2,500?

You do not have to close your Money Market account; however, if your balance falls below $2,500, the account will automatically revert to the savings account rate at that time, by the end of the business day. The account name will remain an “RBFCU Money Market.”

If a transaction, payment or transfer presented electronically or over the phone to an external merchant causes your Available Balance to fall below the minimum requirement of $2,500, the transaction will be rejected and returned unpaid. For complete details, please review our Truth in Savings Account Disclosures.

When your balance is brought back up to $2,500, you will earn the RBFCU Money Market rate again.

-

What's the difference between the dividend rate and APY?

APY means Annual Percentage Yield. This refers to how much money you earn on a deposit over a year, taking into account compounding interest. The dividend rate is the declared annual dividend rate paid on an account, which does not reflect compounding.

-

When are dividends paid out on Money Market accounts?

Dividends are paid out monthly.

-

Can I monitor all of my debit and credit cards with MemberSafe?

Yes. If you are a MemberSafe user, you can monitor any debit, credit card and ATM cards by registering each card on membersafe.rbfcu.org.

-

Do I qualify for the Cellular Telephone Protection?

If you are a MemberSafe user, your cell phone bill must be paid using your RBFCU Checking, Savings or Credit Card account to qualify for the Cellular Telephone Protection service.

-

How do I know what is covered under the Cellular Telephone Protection?

Reference the “Guide to Benefit” you received when you signed up for the MemberSafe program or visit membersafe.rbfcu.org for complete details of coverage.

-

How do I sign up for alerts regarding changes to my credit?

Sign up for MemberSafe services through your Online Banking account. Once that is completed, you will be given access information to membersafe.rbfcu.org. To sign up for alerts regarding changes to your credit, you will have to register for the credit monitoring feature through membersafe.rbfcu.org.

-

How do I sign up for Identity Monitoring?

Once you have signed up for MemberSafe services through your Online Banking account, you will be given access information to membersafe.rbfcu.org. To sign up for Identity Monitoring, you will have to register and activate the feature through membersafe.rbfcu.org.

-

How do I sign up for MemberSafe?

Sign in to your Online Banking account and visit the Identity Protection page. To make your MemberSafe coverage selection in the RBFCU Mobile app, tap the + button in the bottom menu, then “View Services,” then “Identity Protection.”

-

How often can I request my credit report with MemberSafe?

If you are a MemberSafe user, you can request an updated TransUnion credit report every 180 days or upon opening a resolution case.

-

How will I be notified if there are any changes to my credit information?

If you are a MemberSafe user, you will receive notifications based on the settings you set. You can set or make changes to your notification preferences at membersafe.rbfcu.org.

-

I currently have IDProtect Plus. How do I upgrade to MemberSafe?

You can upgrade to MemberSafe at any time. Sign in to your Online Banking account and visit the Identity Protection page to make your coverage selection.

To make your MemberSafe coverage selection in the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Tap the + button in the bottom menu.

- Choose “View Services.”

- Select “Identity Protection.”

Once you have upgraded to MemberSafe, you can no longer re-enroll in IDProtect Plus.

-

I currently have IDProtect. How do I upgrade to MemberSafe?

You can upgrade to MemberSafe at any time. Sign in to your Online Banking account and visit the Identity Protection page to make your coverage selection.

To make your MemberSafe coverage selection in the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Tap the + button in the bottom menu.

- Choose “View Services.”

- Select “Identity Protection.”

Once you have upgraded to MemberSafe, you can no longer re-enroll in IDProtect.

-

What should I do if my identity is stolen?

If your credit or personal information is stolen or compromised, it’s important that you take quick action to stop further damage to your credit and identity. For more information on what to do after identity theft, review our article Five Steps to Take Immediately After Identity Theft. To file a claim, call 1-866-210-0361.

-

Can I take a loan from my IRA?

The IRS does not allow loans against an IRA. One option IRA owners have to alleviate taxation and an IRS early withdraw penalty is to roll back a single distribution amount, in full, to an IRA within 60 calendar days. Any distribution amount not rolled back within 60 calendar days is subject to taxes and an IRS early withdraw penalty. All distributions and funds rolled back into the IRA are reported to the IRS and are included when filing taxes. The IRS allows this option only once in a 12-month calendar period.

-

Do I have to start taking IRA distributions at a certain age?

Per IRS guidelines, when a Traditional IRA owner reaches Required Minimum Distribution (RMD) age, an annual distribution is required. Roth IRAs are not subject to an RMD.

-

How can I change beneficiaries on my IRA account?

Updates can be requested at an RBFCU branch or by phone upon member verification and completion of a new IRA Designation or Change of Beneficiary Form.

Upon the passing of an IRA owner, RBFCU pays the IRA funds based on the current IRA Designation or Change of Beneficiary Form you have provided.

-

How do I request an IRA distribution?

Although the intent of an IRA is to accumulate funds for retirement, IRA funds are accessible at any age*. IRA distributions may be requested at an RBFCU branch or by phone upon member verification. Requested distributions will be processed during business hours when proper documentation is received. IRA distributions are subject to taxes at the IRA owner’s tax bracket for the year funds are taken. RBFCU employees are not licensed tax advisors and are not able to determine the IRA owner’s tax liability.

*IRA distribution may be subject to IRS early withdraw penalty.

-

What is an SEP IRA?

An SEP IRA is a Simplified Employee Pension Individual Retirement Account. This type of IRA is established by employers to make tax-deductible contributions on behalf of eligible employees.

-

What's the difference between an IRA offered by RBFCU Investments Group and an IRA offered by RBFCU?

RBFCU Investments Group financial advisors offer IRAs through Ameriprise Financial. Your financial advisor can help you choose investment solutions from a variety of managed accounts, mutual funds, annuities and stocks.

RBFCU offers IRAs. A credit union employee in the IRA department can help you choose if you should deposit your money in an IRA savings account or an IRA certificate of deposit. The IRAs offered by RBFCU are insured separately up to $250,000 from other deposit accounts by the National Credit Union Administration (NCUA). IRAs offered by RBFCU Investments Group are not insured by the NCUA.

-

Am I getting charged every time I receive an Alert?

Alerts are a free service provided by RBFCU. We will not charge you for Alerts and you can set up as many as you wish. However, if you choose mobile/text Alerts, you may be charged additional fees by your mobile service provider.

-

Are my chats with Brooke AI Assistant recorded?

Like all RBFCU Member Service interactions, we log chats with Brooke to monitor for quality assurance, and to identify opportunities to improve Brooke’s responses and accuracy.

-

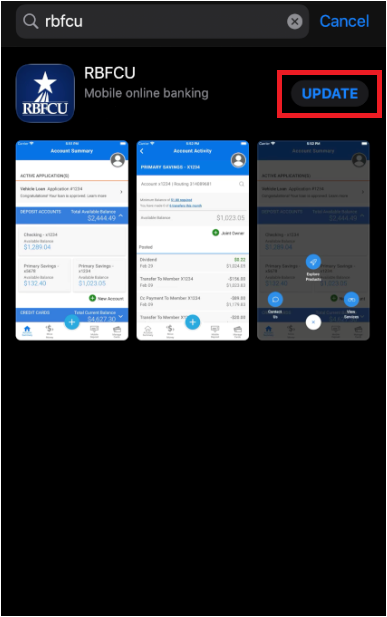

Are older devices supported by the RBFCU Mobile app?

Older devices that are unable to run the latest operating system (OS) versions may not receive the OS security updates needed to run the RBFCU Mobile app. If you have an older device or you choose to use an older OS version on your device, you may not be able to access or use all the features available in the RBFCU Mobile app.

Additionally, only certified devices are supported by the RBFCU Mobile app. If you need assistance with your device, please contact your mobile carrier or device’s manufacturer.

If you have an older mobile device, you can still access your Online Banking account by visiting rbfcu.org on your device’s browser.

-

Can a joint account owner access the primary account owner's Bill Pay profile?

Your Bill Pay profile is only linked to your Online Banking profile. Since each member has their own Online Banking profile, your joint owner can set up their own Bill Pay profile if they need to manage certain bills.

-

Can any type of check be scanned for Mobile Deposit?

You can only scan single-party domestic checks made payable to the owner(s) of the account.

Members are not permitted to deposit the following items via Mobile Deposit, per the Mobile Deposit User Agreement:

- Any item drawn on my Account or my affiliate's Account at RBFCU.

- Any item that is stamped with a "non-negotiable" watermark.

- Any item that contains evidence of alteration to the information on the check.

- Any item issued by a financial institution in a foreign country.

- Any item that is incomplete or inconsistent.

- Any item that is "stale dated" (more than six months from its date) or "postdated" (dated in the future).

- Any third party check, (i.e., any item that is made payable to another party and then endorsed to me by such party).

- Any item previously submitted for deposit.

- Any item that is a traveler’s check or savings bond.

- Any item that is not payable in United States currency.

- Any item payable to any person other than me or entity other than you.

- Any item payable to two (2) or more persons not alternatively, unless deposited into an account owned by all payees.

- Any item authorized over the telephone or otherwise lacking the original signature of the person authorizing the check (such as a remotely created check).

- Any item that is an electronically created item (such as an item that did not exist in paper form).

-

Can I access my account if fingerprint or face recognition don't work on my phone?

Yes. You will always have the option to sign in to the RBFCU Mobile app with your username and password.

-

Can I add more than one checking account in Bill Pay?

Yes. Any checking that is available in your Online Banking account will be an option for payment in Bill Pay. You will choose a default checking payment method, but you can also select other available checking accounts if needed.

To manage your checking accounts or add another account to RBFCU Bill Pay:

- Sign in to your Online Banking account or the RBFCU Mobile app.

- Select “Move Money” from the menu.

- Select “Pay a Bill.” Bill Pay will open in a new tab.

- Select “Manage Billers”

- Select Biller you wish to edit

- Click 3 dots

- Click “View/Edit Biller”

- Under Payment method, click “Edit”

- Select desired Checking Account for Payment Method

- Click “Save Payment Method”

(You’ll have the option to save this account as your default payment method.)

-

Can I change my username, password, or security questions and answers from the RBFCU Mobile app?

Yes. To change these security settings:

- Sign in to the RBFCU Mobile app.

- Tap the profile icon in the top-right corner of the screen.

- Tap “Profile Settings.”

- Tap “Security Center.”

- Select “Username,” “Password,” or “Security Questions and Answers” and follow the prompts to change the setting.

-

Can I change or delete a 'Favorite'?

To delete a Favorite, visit the Transfer Money to Myself or Joint page in your Online Banking account, and select “Remove Favorites” at the bottom of the screen.

To delete a Favorite in the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Tap “Move Money” in the bottom menu.

- Tap “Transfer/Send Money,” then “Send Money to Myself or Joint.”

- Select “Remove Favorites” at the bottom of the screen and follow the prompts.

Please note: You cannot edit a Favorite at this time. If you need to change a Favorite, please remove it and add it again with the correct information.

-

Can I opt out of sign-in Alerts for my Online Banking account?

No. Sign-in Alerts are mandatory security Alerts that cannot be disabled.

-

Can I opt out of transfer Alerts for my Online Banking account?

No. Transfer Alerts are mandatory security Alerts that cannot be disabled.

-

Can I request to increase my daily/monthly Mobile Deposit limit?

Yes, you can contact our Member Service Team to request an account review if you need a temporary increase to your current Mobile Deposit limit.

-

Can I reset my username or password from the RBFCU Mobile app?

Yes. Open the RBFCU Mobile app on your phone, and tap “Having Trouble Signing In?” Follow the prompts to reset your username or password.

-

Can I schedule a recurring transfer within my account or to another RBFCU account holder?

Yes.

To set up a recurring transfer to one of your RBFCU accounts, visit the Transfer Money to Myself or Joint page in Move Money in your Online Banking account.

To set up a recurring transfer to another person’s RBFCU account, visit the Send Money to Someone Else page in Move Money in your Online Banking account.

Complete the transfer details, and tap “Schedule for Future.” You’ll be given options to choose a transfer “Frequency,” “Start Date” and “End Date” to set up a recurring transfer.

To set up a recurring transfer in the RBFCU Mobile app:

- Sign in to the app.

- Tap “Move Money.”

- Tap “Transfer/Send Money.”

- Select whether you’d like to send money to “Myself or Joint” or “Someone Else.”

- Complete the transfer details, and tap “Schedule for Future.” You’ll be given options to choose a transfer “Frequency,” “Start Date” and “End Date” to set up a recurring transfer.

-

Can I set up a recurring payment using my external account?

You can, but first you’ll need to link and verify your external account using Plaid.

- Select the “Move Money” menu in Online Banking or the RBFCU Mobile app.

- Select “Make a Payment.”

- Select “Add Other Account,” then “External Account.”

- Enter your external account details and select “Add External Account.”

- You’ll be asked to validate your account through Plaid while initiating the recurring payment.

-

Can I still chat with a Member Service Representative instead of Brooke AI Assistant?

Yes. Brooke is designed to assist our Member Service Representatives with routine inquiries and enhance efficiency but does not replace human expertise or decision-making. Our friendly representatives will still be available if you need them; just ask!

-

Can I transfer to an account at another financial institution?

Yes. If you’re transferring funds to another person’s account, you will need the account holder’s name, their account number, their financial institution’s routing number and their account type to complete the transfer details.

Click here to sign in to your Online Banking account and set up a transfer to an external account, and enter the required information to complete.

To set up a transfer to an external account in the RBFCU Mobile app:

- Sign in to the RBFCU Mobile app.

- Select the “Move Money” menu.

- To create a new transfer, select “Transfer/Send Money,” then “Send Money to Someone Else.”

- Select “Account.”

- Select “Add Other Account” and enter the details.

- If you send to this account frequently, check the “Add to Favorites” box to save it for next time.

-

Do I have to accept the Terms and Conditions to use the RBFCU Mobile app?

Yes. Members are required to accept the Terms and Conditions after installing and opening the app before they are able to sign in.

-

Do I have to use MFA with my Online Banking account?

No. If you’re more comfortable using RBFCU’s other options — OTP via text message or phone call, and security questions and answers — you’re free to keep using them. However, MFA is a much stronger security option to protect your account and very difficult for fraudsters to infiltrate.

-

Do I need the RBFCU Mobile app to use Brooke AI Assistant?

No. While you can access Brooke in the RBFCU Mobile® app, Brooke is also available by selecting “askRBFCU” in the top-right corner of rbfcu.org or the chat icon in rbfcu.org, or with the chat icon in your Online Banking account.

-

Do I need to include a deposit slip with my check when using Mobile Deposit?

No. The Mobile Deposit program generates an electronic record with each deposit.

-

Does RBFCU offer Zelle?

While RBFCU does not offer Zelle®, you can use Move Money within your Online Banking account or the RBFCU Mobile app to instantly send money to anyone using a phone number or email address — even your friends who aren’t RBFCU members yet.1 All you need is an active RBFCU Freedom Debit Card linked with your account to get started. Your friend or family member will receive a text or email message from RBFCU, directing them to a website where they can use their debit card2 to accept the money.

You can also request money from other RBFCU members via Move Money without having to exchange account numbers.3 To access Move Money, tap the “Move Money” icon at the bottom of the RBFCU Mobile app, or sign in to your Online Banking account and select the “Move Money” menu.

Since RBFCU does not offer Zelle, anyone sending you money will need to utilize another form of transfer from their financial institution.

1For complete details, read the RBFCUsend User Agreement.

2Transfer recipients that are not RBFCU members must use a Mastercard®- or Visa-branded debit card to accept any RBFCUsend transfers.

3“Request Money” feature for use with other RBFCU members only.

-

Does the RBFCU Mobile app use push notifications for account Alerts?

No. The RBFCU Mobile app uses push notifications to alert you regarding sign-in attempts from an unrecognized device, to update you on the status of loan applications, and for activity in the STAR program.

Account Alerts — those that notify you to transactions made on your RBFCU accounts by type and amount — are sent via email and text message. Visit the “Set Alerts” page in your Online Banking account to manage your Alerts.

To manage Alerts in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Set Alerts.”

- Select the type of Alert you’d like to manage from “Account & Loan Alerts,” “Card Alerts” or “Other Alerts.”

- Choose an account and follow the prompts to set your Alert preferences.

-

How can I cancel Bill Pay?

To cancel Bill Pay service, please call us at 210-945-3300 to speak with a Payment Services Representative.

-

How can I clear the data and cache for the RBFCU Mobile app?

To clear the data and cache for the RBFCU Mobile app on an Android device:

- Open “Settings.”

- Tap “Apps.”

- Tap the RBFCU Mobile App.

- Tap “Storage.”

- Tap “Clear Data.”

While Apple devices don’t have a specific option to clear cached data, restarting your device may resolve any issues you may be experiencing. If restarting doesn’t work, uninstalling and reinstalling the RBFCU Mobile app will clear all data.

-

How can I enroll in electronic statements for my credit card online?

To enroll in electronic statements for your credit card:

- Sign in to your Online Banking account or the RBFCU Mobile app.

- Select your credit card on the Account Summary page.

- Select “View More” on the Credit Card Activity page to open the credit card servicing website.

- Select “Statements.”

- Select the toggle next to “Paperless statements" to switch it to “On.”

- Verify your email address, and follow the prompts to complete enrollment.

Please note: You will only be enrolled in electronic statements for your credit card. This will not apply to your other RBFCU accounts.

-

How can I locate my nearest RBFCU branch or ATM using the RBFCU Mobile app?

To locate your nearest RBFCU branch or ATM:

- Sign in to the RBFCU Mobile app.

- Tap the + button at the bottom of the screen to view your options.

- Tap “Contact Us.”

- Select “Locate a Branch or ATM” to open the location search.

-

How can I manage permission settings for the RBFCU Mobile app on my device?

You can change permissions to allow or deny apps to use various features on your phone, such as your camera or contacts list in your phone’s Settings.

Please note: Settings can vary by phone. For more information, contact your device’s manufacturer.

For Apple users:

- Open the Settings app on your device.

- Scroll down to the list of apps at the bottom, and choose the RBFCU Mobile app (listed as “RBFCU”).

- Here, you can choose to enable or disable permissions for specific app features.

For Android users:

- From the Home screen, swipe up to access “All Apps.”

- Find and open the Settings app.

- Tap “Apps & Notifications.”

- Tap the RBFCU Mobile app (listed as “RBFCU”). If you can't find it, first tap “See all apps” or “App info.”

- Tap “Permissions.” Here, you can enable or disable permissions for specific app features by tapping a feature, then choosing “Allow” or “Deny.”

-

How can I review my trusted devices in Online Banking?

Visit the My Devices page in your Online Banking account to review your trusted devices.

To review your trusted devices in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Profile Settings.”

- Select “Security Center.”

- Select “My Devices” to see a list of devices with access to your account.

-

How can I view my investments and accounts through RBFCU's Online Banking and the RBFCU Mobile app?

To view investments and accounts through our Online Banking platform at rbfcu.org or the RBFCU Mobile app, start by signing in and selecting “Explore Products” on the navigational toolbar. Then select “Investments.” (For mobile app users, tap the plus sign icon (+) at the bottom, select “Explore Products” and then click the “Investments” card.)

Follow the prompts, and from there, your investments and accounts will automatically appear.

-

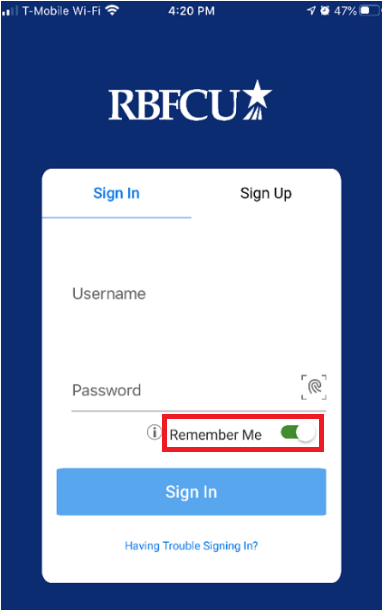

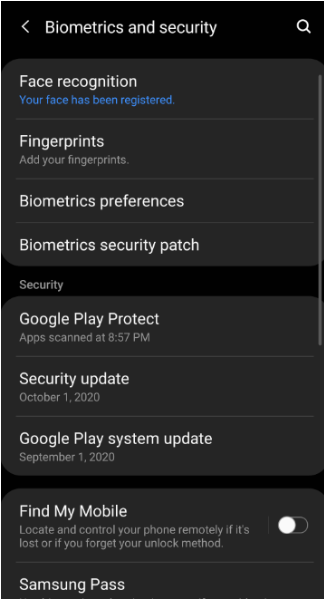

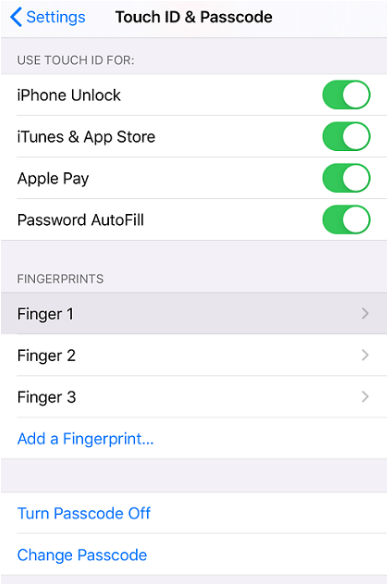

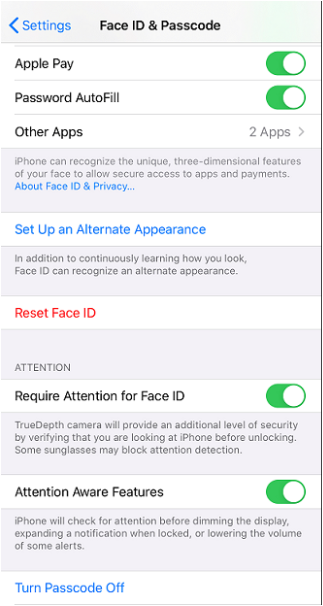

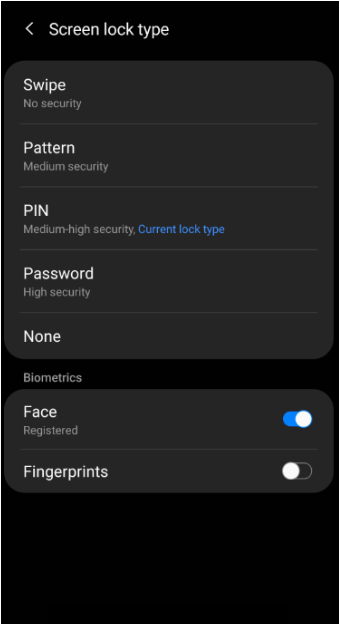

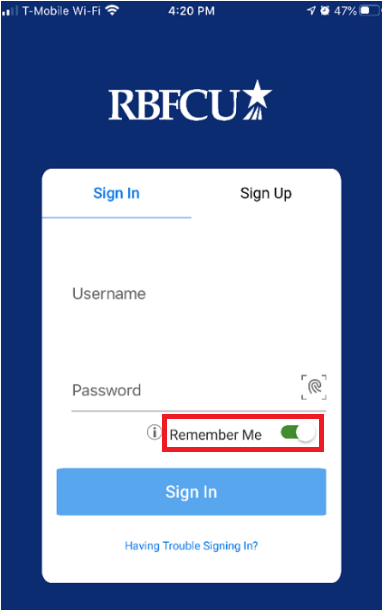

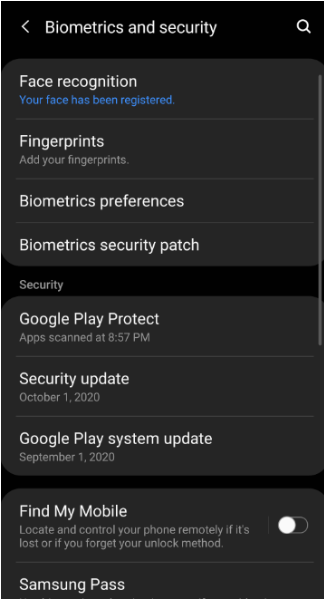

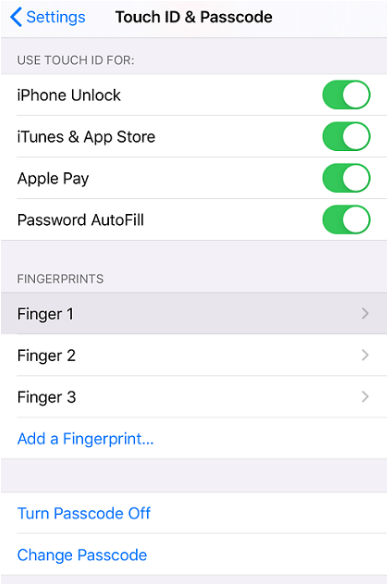

How do face and fingerprint options work with the RBFCU Mobile app?

The RBFCU Mobile app’s “Remember Me” option allows you to use face or fingerprint (biometric) options to identify and authenticate you when signing in to your account.

Once you enable Remember Me within the app, you will be prompted to sign in with your username and password at least once to verify. Your username and password will be captured, and you can sign in using a biometric option starting next time you sign in.

-

How do I access Brooke AI Assistant?

You can access Brooke by selecting “askRBFCU” in the top-right corner of rbfcu.org, or with the chat icon in your Online Banking account or the RBFCU Mobile® app.

-

How do I access Mobile Deposit from the RBFCU Mobile app?