RBFCU Round Up

Automatic Savings Every Time You Spend

Save money without even trying! When you enroll in RBFCU Round Up, purchases made with your Freedom Debit Card or your Freedom Business Debit Card will be rounded up to the nearest dollar and the difference will be funded by your own checking account and transferred into an eligible RBFCU account at the end of each day.

It All Adds Up

Think about the purchases you make with your debit card on a regular basis. Can’t live without that morning latte or that delicious turkey sandwich from the sandwich shop around the corner? Every round up, adds up.

How Round Up Works

1. ENROLL

To enroll, sign in to Online Banking or the RBFCU Mobile® app.

You can also speak with a Member Service Representative by starting a chat, calling 210-945-3300 or visiting your nearest branch.

2. USE YOUR CARD

Use your debit card for everyday purchases in person or online! Setting up your debit card for recurring payments like streaming services or your gym memberships will also help you increase your Round Up savings.

3. SAVE

Every purchase you make with your debit card will round up to the nearest dollar and the difference will be funded by your own checking account and transferred into your designated eligible account at the end of each day. You can even transfer the savings into another RBFCU member’s account!

Call us at 210-945-3300, sign in to Online Banking, or the RBFCU Mobile app or visit any branch to enroll today!

Stay in the Know with Round Up Alerts

With Round Up, you can stay informed in real time with notification Alerts. You can choose to receive text messages or emails each time a transaction rounds up and adds to your savings. You can enable these Alerts when you're enrolled in Round Up through your Online Banking account.

Don’t have a Freedom Debit Card?

In addition to programs like RBFCU Round Up, with a Freedom Debit Card you’ll have access to benefits that help you save time and money, including:

- $0 minimum balance required

- Begin earning the stated Annual Percentage Yield (APY) with an account balance greater than $0

- 24/7 fraud monitoring and $0 liability for unauthorized debit card purchases

- Free online RBFCU Bill Pay®

- Earn interest/dividends monthly

- Mobile and contactless payment compatibility for added convenience and security at thousands of merchants

- Free standard checks

- Free ATM services through RBFCU ATMs and the CO-OP Network

- Set card usage Alerts through the Manage Cards feature

-

What is the Round Up program?

To help you grow your savings, the Round Up program rounds up eligible point-of-sale RBFCU Freedom Debit Card or Freedom Business Debit Card purchases to the next dollar and transfers the proceeds from your own checking account into an active RBFCU personal or business Savings or Checking account designated by you. As RBFCU Freedom Debit Card or Freedom Business Debit Card transactions are posted, the round up amount is calculated at the end of day and moved into the designated RBFCU account. This service is free for members. External accounts at other financial institutions are not eligible to receive Round Up proceeds.

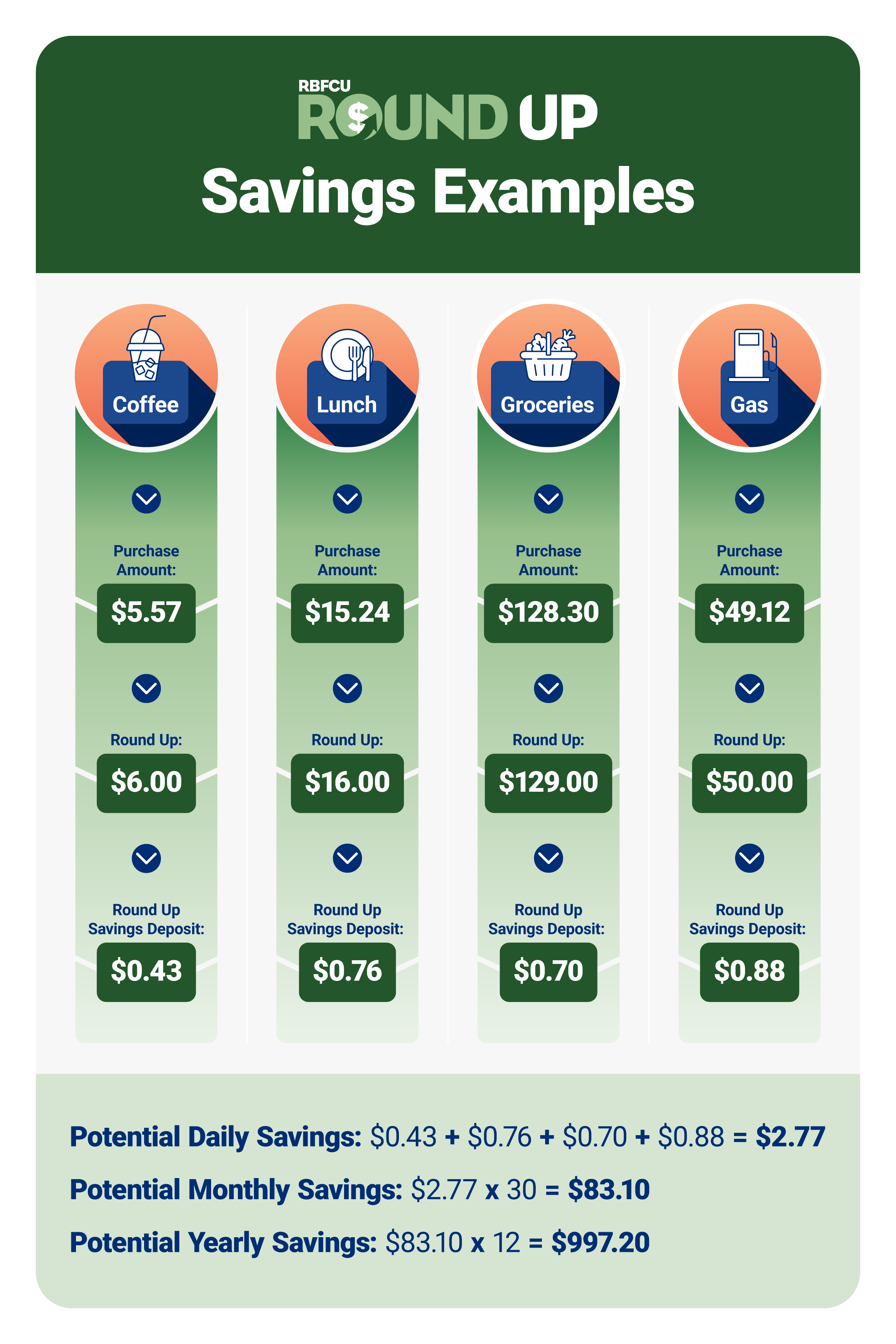

Example: When you purchase a coffee for $5.57, the amount is rounded up to $6.00. $5.57 goes towards the purchase and the difference of $.43 is transferred into your designated RBFCU Round Up account.

For the transaction to round up, there must be sufficient funds in the Checking account. When funds are available to only cover the purchase, the transaction is completed without the round up amount. Round Up transactions are considered a transfer. They will appear on your Online Banking account and RBFCU statement.

You can enroll, opt out, or change the designated receiving account at any time by contacting an RBFCU representative by phone at 210-945-3300 or by starting a chat, or by visiting the Round Up page in your Online Banking account or the RBFCU Mobile app.

-

What accounts can be used to receive Round Up proceeds?

The following RBFCU account types are eligible for members to select as the receiving account for the Round Up program:

- Basic Business Checking

- Business Money Market

- Business Savings

- Checking

- Choice Money Market

- Classic Money Market

- Elite Business Checking

- IOLTA Checking

- Non-Interest Checking

- Non-Interest Savings

- Organizational Checking

- Preferred Business Checking

- Primary Savings

- Savings

- Another member’s eligible RBFCU account. Note: The account owner of the sending account does not have to be an owner on the receiving account

Exception: IRA Savings accounts can not receive Round Up proceeds.

-

When am I eligible to enroll in the Round Up program?

You are eligible to enroll in the Round Up program on the day that you join RBFCU and have an active Checking account linked to an RBFCU Freedom Debit Card.

-

When an account balance is zero or negative, do funds still round up?

No. When the account balance is zero, negative, or becomes zero after the round-up transaction, the application does not round to the next dollar amount.

-

Can I receive an Alert to see how much I've saved with Round Up each month?Yes.

-

How do I enroll in Round Up Alerts?To enroll in Round Up Alerts, sign in to Online Banking or the RBFCU Mobile® app. From the "View Services" menu, select "Set Alerts", then from the "Account and Loan Alerts" section, select your checking account from the dropdown menu. Toggle the radio button next to "Round Up Alerts", select your preferred Alerts notification method, then select "Save".

-

When will I receive Round Up Alerts?If your eligible checking account was enrolled in Round Up the previous month, an Alert showing your Round Up savings from the previous month will be sent to you via your preferred notification method on the 1st of the following month.

Membership eligibility required. Programs subject to change without notice; other restrictions may apply. Savings example for reference only. Savings will vary based on the number of purchases and purchase amounts made using your Freedom Debit Card. Members must have an RBFCU Checking Account with Freedom Debit Card to enroll in RBFCU Round Up. Debit card purchases eligible for Round Up will be calculated nightly. Round ups will be funded via a transfer from the checking account associated with your Freedom Debit Card to the designated receiving account. For a transaction to round up, the checking account balance must be sufficient to process the transaction and the transaction amount must not be a whole dollar amount. A round up will not occur if the account balance is zero, negative or becomes zero after the round-up transaction. We may cancel or modify the Round Up program at any time without prior notice.

The following account types are eligible for members to select as the receiving account for Round Up: Primary Savings, Savings, RBFCU Choice Money Market, RBFCU Classic Money Market, Business Savings, Business Money Market, Non-Interest Savings, Checking, Basic Business Checking, Preferred Business Checking, Organizational Checking, Elite Business Checking, Non-Interest Checking and IOLTA Checking. Members enrolling in Round Up can also choose another member’s eligible RBFCU account to receive the Round Up savings. IRA Savings accounts are not eligible as a receiving account for Round Up.

Zero Liability applies to transactions that have been promptly reported and determined by RBFCU as unauthorized, subject to terms and conditions in accordance with RBFCU's Electronic Funds Transfer Agreement at rbfcu.org/eft.

Enrolling in Alerts is free, but you may be charged for text messages by your mobile wireless provider. Alerts are a supplemental service and are not a replacement for responsible account review and management. You are responsible for any fees or charges incurred on your account whether you receive your Alerts or not. RBFCU does not charge a fee for the RBFCU Mobile app, but you may be charged for data by your mobile wireless provider.