8 Things to Know About Cryptocurrency

Cryptocurrencies like bitcoin, ethereum and dogecoin have emerged in recent years, causing a whirlwind of confusion. Whether you’re a seasoned investor or just beginning to explore, this new digital realm can be perplexing.

Should you get in on it? Is it legit? Let’s dig into this mysterious new form of money.

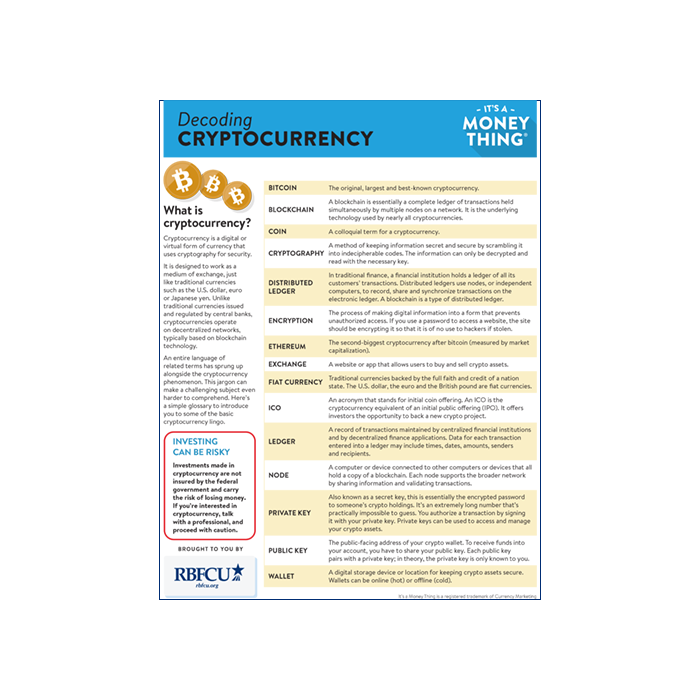

1. What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It is designed to work as a medium of exchange, just like traditional currencies such as the U.S. dollar, euro or Japanese yen.

Unlike traditional currencies issued and regulated by central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

(Article continues below video)

What does that mean to you?

It means that your money is secret. You access your virtual money (cryptocurrency) through a secure website or app to make transactions. Only you (or whoever has your login password) can access your cryptocurrency and make transactions.

If you lose your private keys, have questions or need any help, you are on your own. There is no banker or help desk that you can call.

2. What is bitcoin?

Bitcoin is the first and most well-known cryptocurrency. It operates on a peer-to-peer network, meaning that transactions can be conducted directly between users without the need for intermediaries such as credit unions or banks.

One of the key features of bitcoin is its limited supply. There will only ever be 21 million bitcoins in existence; this scarcity is designed to give it value over time. Bitcoin has gained considerable attention and popularity, as it is increasingly perceived as a valuable asset, an investment opportunity driven by speculation and a medium of exchange for online transactions.

Bitcoin is just one of many. There are hundreds of cryptocurrencies available today, including ethereum, ripple, litecoin, cardano and dogecoin, to name just a few.

3. How can you use cryptocurrency?

Cryptocurrency can be used to purchase goods and services, just as you’d use physical money. While not universal, a few major brands do accept bitcoin as a legitimate source of funds. Examples include:

- Wikimedia, the company that operates the world’s largest open-source encyclopedia, Wikipedia, accepts donations in bitcoin

- Microsoft allows the use of bitcoin to top up your online Microsoft account

- AT&T is the first major U.S. mobile carrier to provide a cryptocurrency payment option to customers

You can also invest in cryptocurrency, which means you are using it to potentially make money.

4. Why would you invest in cryptocurrency?

The purpose of investing in anything, including cryptocurrency, is to make money. There is opportunity to make money with cryptocurrency; however, there is also a risk that you will lose money.

If you’re interested in cryptocurrency, talk with a professional and start small, with an amount that you could afford to lose without breaking a sweat.

5. Is your money protected when it’s in cryptocurrency?

The level of protection for your money when it’s in cryptocurrency is dependent on several factors.

Security Measures: Cryptocurrencies use cryptographic techniques and secure protocols to protect transactions and holdings. The underlying blockchain technology provides inherent security features. However, it’s crucial to ensure that you take appropriate security measures on your end. This includes using strong passwords, enabling two-factor authentication and keeping your private keys secure.

Decentralization: Cryptocurrencies operate on decentralized networks, which can make them less susceptible to certain types of attacks or manipulation. The distributed nature of blockchain technology can enhance security and resilience against single points of failure.

Risk of Hacks and Scams: While cryptocurrencies offer security features, the ecosystem surrounding them can be vulnerable to hacks, scams and fraud. Exchanges, where cryptocurrencies are bought, sold and stored, have been targeted by hackers in the past. It’s crucial to choose reputable and secure cryptocurrency exchanges, and to employ best practices to protect your funds.

Insurance Coverage: In the United States, the federal government regulates credit unions and banks. Money held in credit unions is insured by the NCUA (National Credit Union Administration), and money held in banks is insured by the FDIC (Federal Deposit Insurance Corporation). In contrast, money held in cryptocurrencies is not covered by the federal government whatsoever. Some cryptocurrency exchanges may offer some protections, such as insurance coverage for user funds. It’s important to research and verify the security measures and insurance policies of any service that you use.

6. Is investing in cryptocurrency wise, then?

That’s for you to discuss with your trusted financial planner.

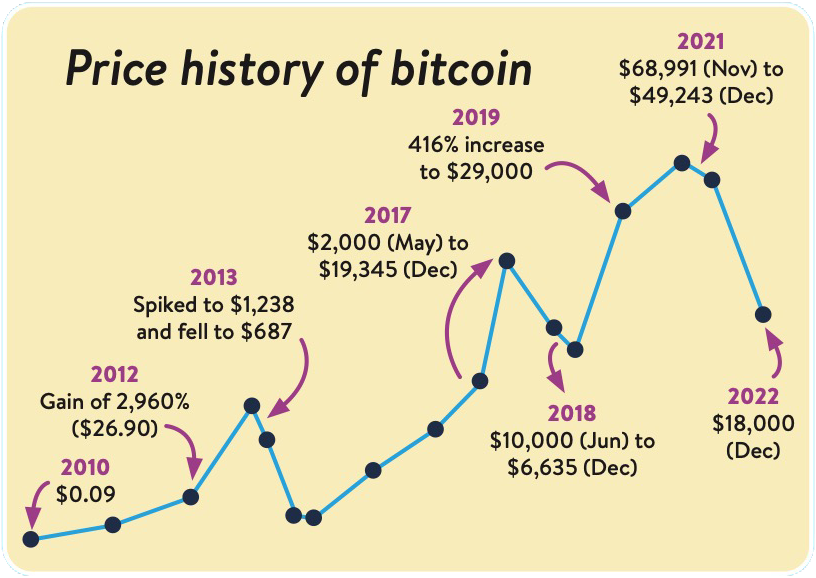

However, always remember that the crypto market can be very volatile. It’s important that you understand what you’re investing in, and even more crucial that you understand the associated risks.

For example, look at the constantly moving value of bitcoin. This shows how volatile the market is. Ask yourself if you can afford to risk your money in this kind of roller-coaster scenario.

7. Can I convert cryptocurrency into cash?

Yes, this is done through a virtual wallet. Just like the traditional wallet you carry around, the virtual version holds your money, only digitally.

To convert your funds to cash, you can add your traditional real-life bank account to your wallet.

8. Do you have to claim your cryptocurrency on your taxes?

Yes, you do. In the United States, the Internal Revenue Service (IRS) treats cryptocurrencies as property, rather than as currency, and general tax principles that are applicable to property transactions apply to transactions using cryptocurrency.

Please note that tax regulations and requirements can change, so it’s advisable to consult with a tax professional or accountant who can provide specific guidance based on your individual circumstances.

Cryptocurrency will likely increase in popularity as more people explore this investment option. As with all your investments, do the research and consider working with a professional so that your money can grow for you while you get a good night’s sleep!

Sources: 99bitcoins.com, Canadian Living, Internal Revenue Service, Investopedia