Paying For Pets: The 3 Hidden Expenses of Pet Ownership

According to the American Pet Products Association, nearly 70% of all US households own a pet. That translates into an estimated $86 billion spent on food, supplies, medical care and pet services in 2018. Although the love and companionship our furry (or feathered, or scaly) friends provide is priceless, it’s impossible to ignore the effect that pet ownership has on our wallet.

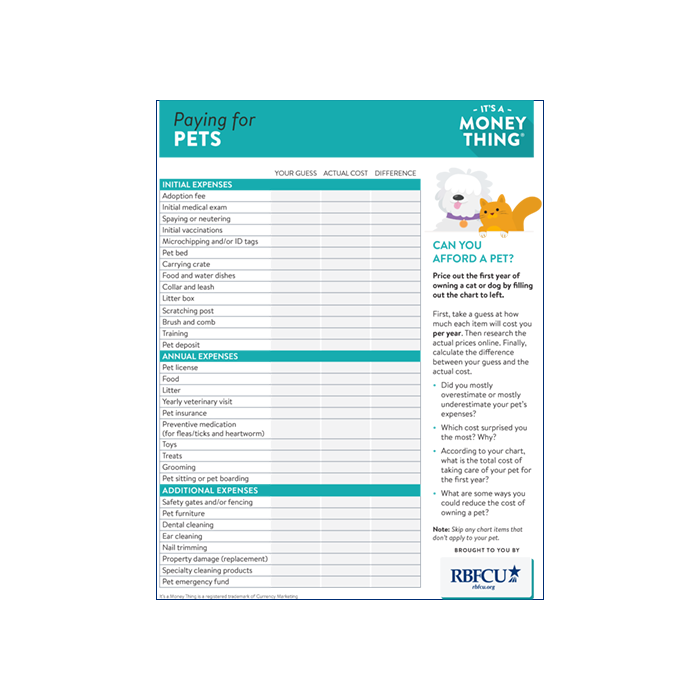

Like walking the dog or scooping out the litter box, budgeting is a part of basic pet care. If you’re thinking about getting a new pet, start by taking a look at your finances. You want to ensure that you can provide for your pet’s regular needs and that you have the ability to respond to emergencies. Searching for pet expense worksheets online is a good starting point and will provide rough estimates for things like adoption fees, food, medicine, supplies and pet services.

As is the case with budgeting for other significant milestones, it can be challenging to anticipate all of the ways a new change will influence your monthly spending. To help you prepare, we’ve outlined three categories of “hidden” expenses below. Though all three are related to pet care, they’re often left out of the average pet budgeting worksheet and therefore have the ability to take you by surprise. Though we’ve written this guide with dogs and cats in mind, similar expenses exist for other pets.

(Article continues below video)

Pet-Proofing

When you welcome a new pet into your home, you’ll likely pick up a few items to make their stay more cozy. A plush dog bed, a fancy scratching post, or other pet furniture helps turn your home into a shared environment where your pet can sleep and play comfortably. Modifying your living space also makes your home safer for your pet. Identifying and eliminating potential hazards before you bring your pet home helps reduce preventable injuries and illnesses (not to mention the associated veterinary bills). Depending on your pet and on your living situation, pet-proofing may include a combination of the following expenses:

• Window screens and/or outdoor fencing. Barriers in strategic places keep your pet from escaping and getting into trouble.

• Houseplants. Many common houseplants are toxic for your pets; remove them or replace them with pet-friendly varieties.

• Gates and grates. These are practical way to keep your pets away from fire hazards (like fireplaces, space heaters and busy kitchens) and electrical hazards (like wires and cords in office spaces and entertainment centers).

• Storage containers. Small storage solutions protect your pet from choking hazards such as batteries, buttons, paper clips, dental floss, and hardware like washers and screws.

• Ramps and pet stairs. Human-scale staircases aren’t always safe for pets to climb. Pet steps make your home more accessible for smaller breeds. Ramps reduce physical strain on older pets with mobility or joint issues.

• Hardware. Wall anchoring kits prevent dressers and bookshelves from tipping over; latches and cabinet locks restrict your pet’s access to dangerous chemicals found in paints, solvents and cleaning products.

Mischief

Even if you’re a watchful pet parent, it’s reasonable to expect a little (or a lot!) of mischief from your pet. This usually results in repairing or replacing damaged items in your home. Budgeting for a little extra property damage will ease the pain when Sparky decides that your brand-new shoes are his favorite chew toy. Though obedience training can help limit the frequency of pricey pet shenanigans, you can still expect to repair or replace a few of the following items:

• Wood furniture. Table legs and chair legs are magnets for chew marks — restore them to their former glory with wood putty and polish.

• Sofas and soft furnishings. With a pet in the house, expect more snags, rips and tears to cushions and soft furnishings.

• Curtains. You may need to replace tangled and claw-marked curtains with more durable window coverings.

• Rugs and carpets. Muddy paws, “accidents” and general wear and tear can dramatically reduce the lifespan of your floor coverings.

• Cleaning supplies. You may find that you’re spending more on specialty stain- and odor-removal products, or on major appliances like pet hair vacuum cleaners.

‘In-Between’ Veterinary Bills

Medical expenses should not come as a total surprise — as a new pet owner, you should already be budgeting for routine veterinary visits and have a healthy emergency fund set aside for serious medical issues. That said, there are some pet health expenses that fall outside of both regular checkup territory and emergency territory. Depending on your pet’s needs, you may be faced with one or more of the following overlooked medical expenses:

• Allergies. Your pet might be sensitive to certain allergens and may require specialty foods that drive up your monthly pet food costs.

• Ear and dental care. Some breeds need extra attention when it comes to cleaning their ears and teeth. If you don’t have the time or ability to do it yourself, make sure you make room in your budget for those extra trips to the groomer or the veterinarian.

• Injuries from other animals. Encounters with other critters — both wild and domesticated — can result in bites, scratches and stings that require medical attention.

• Preventive medication. Some medicines, such as heartworm or flea and tick medication, are a regular part of your pet’s well-being and need to be budgeted for.

There are so many pet-related expenses that, even with the best of intentions and a ton of preparation, it’s easy to overlook a few of them. By factoring in the hidden expenses of pet ownership above, you’ll be better able to keep your pet happy, safe and well-cared-for.