Is Retirement on the Horizon? 5 Things to Do to Ensure You're Prepared

If you plan to retire within 10 years, here are a few things to tackle to ensure you are well prepared for the next chapter of your life.

Retirement planning can be a complex endeavor. As you approach your retirement years, it becomes increasingly important to organize your financial affairs effectively.

(Article continues below video)

1. Contribute to your 401(k) & IRA

For many retirement savers, these are the highest-income years of their careers. This is the time to contribute the maximum amounts possible to your employer’s retirement plan, IRA accounts and the like. While these contributions will not have the years to compound as those made in your 20s and 30s, every bit helps.

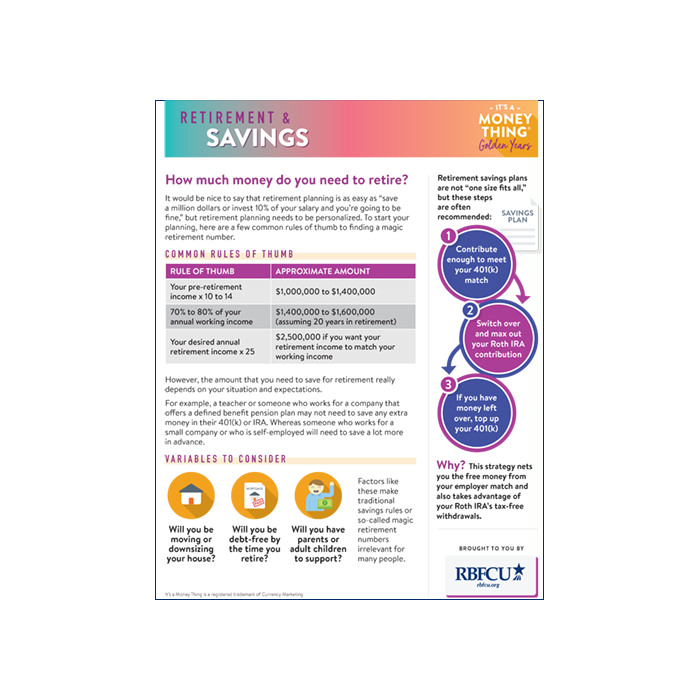

Retirement savings plans are not “one size fits all,” but these steps are often recommended:

- Contribute enough to meet your 401(k) match

- Switch over and max out your Roth IRA contribution

- If you have money left over, top up your 401(k)

Why? This strategy nets you the free money from your employer match and also takes advantage of your Roth IRA’s tax-free withdrawals.

2. Check your Social Security

You can get your statement and check your benefits on the Social Security Administration website.

It’s a good idea to check that you have received full credit for all of your earnings. It’s also important to know and understand what your benefits will be if claimed at different ages.

If you are married, there are a number of strategies to consider in terms of the timing of claiming your benefits. A good calculator can help you decide — two worth trying are the Social Security Administration’s Online Benefits Calculator and AARP’s Social Security Calculator.

3. Gather info for all of your retirement accounts

These days, it’s not uncommon for someone to have worked at a half dozen or more jobs throughout their career. This can lead to a number of retirement plans with former employers. If you’re married and your spouse works, this number can easily double. This is in addition to your Social Security benefits.

You may have old pensions in which you have a vested benefit, old 401(k) plan accounts that have been left with a former employer and ignored over the years, plus multiple IRA accounts and so on.

This is a good time to make sure you have a list of all of these old plans. It’s an even better time to develop a strategy to make sure that old 401(k) and IRA plans are consolidated and properly invested, and that former employers have your current contact information for any old pension accounts.

While many of these old accounts might be relatively small, if you have several, they can add up to real money for your retirement.

4. Figure out other financial resources

This is also a good time to get your arms around your other financial assets that are potentially available to support your retirement lifestyle. These might include:

- Taxable investment accounts

- Annuities

- Life insurance with cash value

- Interest in a business

- Stock options from your employer

5. Determine how much you will need to retire

It would be nice to say that retirement planning is as easy as “save a million dollars or invest 10% of your salary and you’re going to be fine,” but retirement planning needs to be personalized.

To start your planning, here are a few common rules of thumb to finding a magic retirement number.

Rule of thumb

- Your pre-retirement income x 10 to 14 = $1,000,000 to $1,400,000

- 70% to 80% of your annual working income = $1,400,000 to $1,600,000 (assuming 20 years in retirement)

- Your desired annual retirement income x 25 = $2,500,000 if you want your retirement income to match your working income

However, the amount that you need to save for retirement really depends on your situation and expectations.

For example, a teacher or someone who works for a company that offers a defined benefit pension plan may not need to save any extra money in their 401(k) or IRA. Whereas someone who works for a small company or who is self-employed will need to save a lot more in advance.

Variables to consider

- Will you be moving or downsizing your house?

- Will you be debt-free by the time you retire?

- Will you have parents or adult children to support?

How would you like to live?

This is the time to start making some choices about how you will live in retirement and, more importantly, to put some dollar figures onto this lifestyle. Another way to say this is to start thinking in terms of a retirement budget.

Use a retirement calculator

There are many retirement calculators online that can give you an idea of whether your plans for retirement are realistic or not.

Most retirement projection tools will ask you to input your retirement plan assets, any pensions, Social Security and any other investments. Based on variables such as your investment allocation and other factors, these tools will give you an idea of how much retirement cash flow your resources might be able to support.

While you might not like the answer you get, it’s better to know ahead of time that you will have a potential shortfall in your retirement cash flow.

Seek professional advice

This might be a good point to find a competent fee-only financial advisor to assist you. Besides their expertise, a qualified advisor can add a detached third-party perspective to your retirement planning.

Sources: Investopia, Toronto Star