3 Things You Can Do to Help Repay Your Debt

Is debt weighing you down? Paying off your debt is not as simple as racking it up was. You need a realistic debt repayment plan and a desire to get out of debt. Here are three options to help you develop a solid plan.

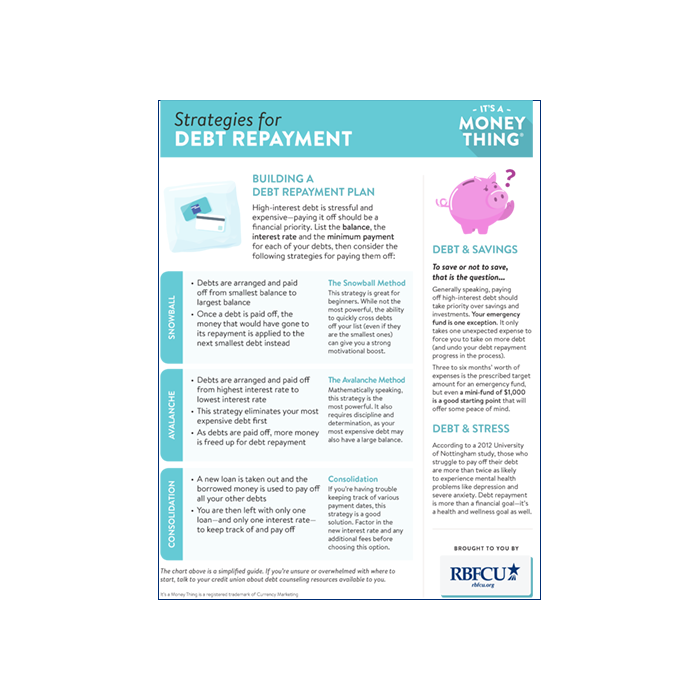

Snowball vs. avalanche

Looking for strategies to pay off debt? The Snowball method pays off the lowest balance first, then moves on to the next lowest balance until you’re out of debt. The Avalanche method starts with the balance that has the highest interest rate, then moves on to the next highest rate until you pay everything off.

Which is the better debt repayment strategy? The Avalanche method will save you more money in the long run, but it really comes down to which strategy will motivate you to reach the goal of being debt-free!

Debt consolidation

Are you carrying expensive consumer debt including credit card balances and high-interest loans? Consider a consolidation loan — this is a form of debt refinancing that entails taking out one loan to pay off other smaller loans.

By consolidating your debt, you pack a bunch of smaller debts into one big debt with a lower interest rate. This will save you money and help you get back on the path to being debt-free.

Don’t give up on your debt

Look at your monthly budget and make a debt repayment plan. If you can, pay more than the monthly minimum to pay down your principal balance quicker, and if you receive any financial windfalls, use them to pay off debt.

If you get off track, regroup and start again the next month. With time, you can be debt-free.