Membership & About RBFCU Frequently Asked Questions

Your questions, answered

We’ve collected some of the most frequently asked questions about joining RBFCU and our products and services, and grouped them by topic to make it easier for you to access the information you need to make informed financial decisions.

Find FAQs by topic:

Membership | About RBFCU | RBFCU Services | Select Group Membership | GreenPath Financial Wellness™ |

Learn & Seminars | Branch Services | Coins / Coinstar® | Branch Wi-Fi |

ATMs |

Safe Deposit Boxes | ID Requirement Policy | Security & Fraud | Back to all FAQs

-

Can my family members qualify for membership?

Yes, your immediate family members (defined as spouse, children, parents, stepparents, siblings and adopted relatives) or household members (people living in the same residence maintaining a single economic unit) can qualify for RBFCU membership through you.

-

Do I have to be a member to get an auto loan with RBFCU?

To secure a loan with RBFCU, membership is required. If you would like to complete your loan application right away, then complete the membership application later, you may access our non-member loan application.

-

Do I have to be military-affiliated to join RBFCU?

No. At RBFCU, we have more than 5,000 ways to qualify you for membership. To see how you qualify for membership, call us at 210-945-3300 today.

-

How do I qualify for membership with RBFCU?

There are several ways to qualify for membership with RBFCU. Common ways to qualify for membership include your employer, place of worship, community organization, neighborhood or school. You may also qualify through immediate family members who are part of the credit union (spouse, children, parents, siblings, stepchildren, adopted relatives, etc.). You can complete a short online application to see if you qualify for membership.

If you are unable to qualify through any of the options listed above, you may contact us and our Member Service Specialists can help you determine if there are additional opportunities to qualify.

-

How long does it take to qualify for membership?

With more than 5,000 ways to become an RBFCU member, qualifying for membership is quick and easy. Join online or visit any RBFCU branch.

-

I was asked questions about another person or about someone I'm no longer associated with during the application process. Why did this happen?

The questions we ask are pulled from public information data sources. RBFCU does not curate this information and you may be asked a question regarding a person with whom you have shared an address in the past.

-

What is a member number?

A member number is assigned to you when you open your account. It is not the same as your account number. It is a number we use to identify you within our internal system.

-

Why do I have to answer these personal questions during the account opening/membership application process?

You may be asked to verify your identity by answering questions from public information sources, including questions about vehicles you or others in your household have owned, questions about addresses/places of residence, etc.

-

Why do I have to qualify for membership?

Unlike banks that are open to anyone, laws require credit unions like RBFCU to have a defined field of membership, which means you have to be a member to access the products and services credit unions provide. There are a variety of ways to qualify based on where you work, live, worship or attend school. When you become a member of RBFCU, you take advantage of lower loan rates, higher dividends on deposits and lower fees.

-

I am a reporter with a media inquiry. Who should I contact?

For media inquiries, please contact Salvador Guerrero, Vice President-Corporate Communications & Public Relations, at sguerrero@rbfcu.org or 210-637-4287.

-

What is a credit union?

Credit unions are not-for-profit cooperatives, owned by their members who save and borrow there. We exist to serve our members, not to make a profit, so credit unions do not issue stock or pay dividends to outside stockholders. Instead, we return our earnings to members by providing lower loan rates, generally pay higher dividends on deposits and charge lower fees.

Credit unions are a democracy. Each credit union member has equal ownership and one vote, regardless of how much money they have on deposit.

Every credit union is governed by a board of directors, elected by and from the credit union's membership. Board members serve voluntarily and receive no compensation.

Credit unions cannot serve the general public; instead, people must qualify for membership. People are eligible for credit union membership through their employer or organizational affiliations like churches or social groups, or a community-chartered credit union.

Credit unions provide beneficial education to their members so they can become better educated consumers of financial services. We not only focus on our adult members, but work to give our youth and young adults the skills they need to become financially savvy.

-

When is RBFCU's annual meeting?

The annual meeting is scheduled for the end of March each year. Watch member communications for date, time and location details.

-

Why didn't I get my payment from the IRS?

If you have questions about the status of an IRS payment — like your tax refund — visit IRS.gov/help. There you can find self-service options, phone numbers for additional assistance and information on locating your nearest IRS office.

-

How is RBFCU Services connected with RBFCU?

An affiliate of RBFCU, RBFCU Services LLC was established to expand the range of financial product solutions, services and strategies available to credit union members.

RBFCU Services is an umbrella for the Credit Union Service Organizations (CUSOs), often referred to as affiliate companies or limited liability companies (LLCs).

Each day, team members across the CUSOs and RBFCU Services collaborate to provide members with a variety of options to help advance their financial well-being as well as personal and professional goals.

-

Is RBFCU Investments Group part of RBFCU?

RBFCU Investments Group LLC is a wholly-owned subsidiary of RBFCU Services LLC. RBFCU Services LLC is affiliated with Randolph-Brooks Federal Credit Union (RBFCU).

RBFCU Investments Group financial advisors are registered representatives of Ameriprise Financial Services, LLC and employees of RBFCU.

RBFCU Investments Group is a financial advisory practice of Ameriprise Financial Services, LLC.

RBFCU offers an investment services program through Ameriprise Financial Institutions Group, a channel of Ameriprise Financial Services, LLC.

Through our relationship with Ameriprise Financial, you have access to wide-ranging advice — from point-in-time investment recommendations and asset allocation strategies, to a comprehensive financial planning approach that covers key aspects of your financial life — to help you meet your goals. And, your financial advisor can provide access to a broad array of solutions to meet your specific needs, including investments, insurance and annuities, and much more.

Ameriprise Financial Services, LLC and its affiliates are entities separate from, and not affiliates of, RBFCU.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

-

What are the Credit Union Service Organizations (CUSOs)?

The Credit Union Service Organizations (CUSOs) are a group of companies affiliated with RBFCU. The primary umbrella is RBFCU Services LLC.

-

Can I qualify my business for membership to open an account?

Yes, you can qualify your business for membership based on your location, or based on where you (the legal owner), live, worship or attend school. If you are interested in allowing your business and employees to take advantage of credit union membership, you can contact our Business Development Team and request the benefits of credit union membership for your entire organization by becoming a Select Group.

-

Do I have to be a Select Group (SG) to get a business loan?

No. RBFCU has more than 5,000 ways to qualify you for membership. To get more information on becoming an RBFCU Select Group, call our Business Development Office at 210-945-3300 , ext. 53827 or email us at membership@rbfcu.org.

-

How can I share the benefits of membership with my employees?

As a Select Group (SG), your employees are eligible for free RBFCU membership. We can provide membership packets to your employees and do on-site credit union membership education sessions — free of charge. RBFCU can have a Business Development Representative coordinate membership materials and information sessions for you. To schedule your on-site RBFCU SG membership sessions, call our Business Development Department at 210-945-3300 , ext. 53827 or email membership@rbfcu.org today.

-

How long does it take to qualify as a Select Group (SG)?

Qualifying your business for membership is an easy process. You can become a Select Group (SG) within five to seven business days. To get more information on becoming an RBFCU SG, call our Business Development Office at 210-945-3300 , ext. 53827 or email us at membership@rbfcu.org.

-

I'm interested in giving my employees every advantage in managing their finances. Does RBFCU offer any kind of financial literacy classes?

RBFCU wants to ensure the financial success of all its members and we offer several different financial literacy classes — most free and a few at a nominal cost — to those we serve. Call our Business Development Department at 210-945-3300, ext. 53827 or email us at financialeducation@rbfcu.org for more information. Click here to request a financial education presentation.

-

What is a Select Group (SG) number? How do I find my SG number?

When your business is approved as an RBFCU Select Group (SG), you are given a number that identifies you in our records. If you forgot your business’ SG number, call our Business Development Department at 210-945-3300 , ext. 53827 or email us membership@rbfcu.org.

-

Why should I qualify my business for credit union membership?

As an RBFCU Select Group (SG), your employees can take advantage of credit union products and services to include on-site presentations and free financial seminars. Qualifying your business for RBFCU membership is a very easy. To learn how to become an RBFCU SG, contact our Business Development Office at 210-945-3300 , ext. 53827 or email us at membership@rbfcu.org.

-

Do I need to make an appointment with GreenPath?

No, an appointment is not necessary. GreenPath professionals are standing by to serve you at 1-877-337-3399.

-

How long does a credit counseling session with GreenPath take?

The initial credit counseling session usually lasts 45 minutes to 1 hour.

-

How much does a GreenPath counseling session cost?

Credit counseling is free. GreenPath will work with you to help you understand your unique financial situation and explore customized options to help you reach your financial goals. You can call GreenPath at 1-877-337-3399 to get immediate counseling.

There is a cost for a debt management plan and enhanced student loan debt counseling. A GreenPath counselor will explain those costs to you if you elect to utilize those services beyond your initial credit counseling session.

-

What if I don't have time to conduct a GreenPath credit counseling session now?

GreenPath can schedule an appointment for a more convenient time or you can call them at 1-877-337-3399 at a time that is convenient for you. GreenPath professionals are available from 7 a.m. to 9 p.m. CT Monday through Thursday, 7 a.m. to 7 p.m. Friday and 8 a.m. to 5 p.m. Saturday.

-

What information can I expect to receive from GreenPath?

All of GreenPath’s counseling sessions are customized to your situation.

If you are struggling to manage your ongoing monthly obligations, you will receive information on money management as well as tips on how to reduce ongoing expenses.

If you are past due on your mortgage, you will receive information on prioritizing payments, how to resolve housing delinquency, etc.

If you are facing several issues, you will receive customized counseling to address all of these items so you are in a better situation to reach your financial goals.

-

What will I need for my initial credit counseling session with GreenPath?

You should have copies of recent bill statements handy such as utilities, credit card, mortgage, auto loan and student loans.

To paint a complete financial picture, GreenPath will also need to know how much money you and your spouse/financial partner bring home each month.

-

Will GreenPath keep my information confidential?

Absolutely. GreenPath does not report information to the credit bureaus and will not share your information with anyone without your permission.

GreenPath does ask you for permission to share information with RBFCU. If you say “no,” your name is kept confidential.

If you begin a debt management program, GreenPath will obtain your consent before it proposes payment arrangements to your creditors.

-

Do I need to be a member of the credit union to qualify for the Youth Ambassador Program?

Membership eligibility is required to participate in the RBFCU Youth Ambassador Program. Click here for more information about joining RBFCU.

-

How do I apply for the RBFCU Youth Ambassador Program?

-

I'm interested in giving my employees every advantage in managing their finances. Does RBFCU offer any kind of financial literacy classes?

RBFCU wants to ensure the financial success of all its members and we offer several different financial literacy classes — most free and a few at a nominal cost — to those we serve. Call our Business Development Department at 210-945-3300, ext. 53827 or email us at financialeducation@rbfcu.org for more information. Click here to request a financial education presentation.

-

Is a scholarship awarded to all students participating in the Youth Ambassador Program?

Each student who satisfactorily completes the Youth Ambassador Program has the opportunity to earn a scholarship. Students are expected to be professional, arrive/depart on time and complete all assignments, which includes giving a financial education presentation to their peers.

-

Is there a dress code for the RBFCU Youth Ambassador Program?

Yes, students are asked to dress in business casual and business professional attire during the RBFCU Youth Ambassador Program. They will receive an RBFCU polo shirt and T-shirt to wear during the program.

-

Is transportation and/or lodging provided for the students participating in the RBFCU Youth Ambassador Program?

No, the student is responsible for their own transportation and/or lodging for the RBFCU Youth Ambassador Program.

-

What does it cost to participate in the Youth Ambassador Program?

No fees or dues are required to participate in the RBFCU Youth Ambassador Program.

-

What if I cannot attend the RBFCU Youth Ambassador Program the entire week?

Participants are required to complete the full week of the RBFCU Youth Ambassador Program to be eligible for the scholarship.

-

What is the RBFCU Youth Ambassador Program?

The RBFCU Youth Ambassador Program is a financial education program that provides students vital personal financial information on topics such as financial services, money management, saving and investing, fraud, credit and insurance. Participants will also explore financial careers, professionalism in the workplace along with strengthening presentation skills. Students will have the opportunity to learn and network with RBFCU employees, interns and other high school students.

-

When does the RBFCU Youth Ambassador Program take place?

The week-long RBFCU Youth Ambassador Program takes place in June. The students meet daily from 9 a.m. to 3 p.m. with snacks and lunch provided.

-

When will I be notified about the RBFCU Youth Ambassador Program?

A selection committee will choose the group of students to participate in the RBFCU Youth Ambassador Program, and the student will be notified by email no later than one month prior to the start of the program.

-

Where does the RBFCU Youth Ambassador Program take place?

The Youth Ambassador Program is held at RBFCU’s headquarters at 1 IKEA-RBFCU Parkway, Live Oak, TX 78233.

-

Who can I contact if I still have questions about the Youth Ambassador Program?

For more information about the Youth Ambassador Program, contact the RBFCU Financial Literacy Team at 210-637-4513, or by email at financialeducation@rbfcu.org.

-

Who is eligible for the RBFCU Youth Ambassador Program?

The RBFCU Youth Ambassador Program is open to current high school juniors and seniors. RBFCU employees, employees of its affiliates, volunteers and their immediate family members are not eligible for the Youth Ambassador Program.

-

Are my safe deposit box contents insured?

No. Insurance is not provided by RBFCU or the National Credit Union Administration.

-

Can I use Samsung Pay at the ATM to withdraw money?

No. Samsung Pay cannot be used at the ATM or at any payment terminal that requires you to insert your card into the reader (e.g. gas stations, vending machines, etc.).

-

Do I need identification to access my safe deposit box?

Yes. To ensure privacy, we must verify your identification. Accepted forms of identification include: U.S. driver’s license; military ID; passport with photo (in English); Permanent Resident Card; or a matrícula consular.

-

Do the Coinstar coin processing machines at my branch accept rolled coins?

No, the Coinstar machines do not accept rolled coins. Coins must be loose when added to the machine for counting.

-

How can I find an RBFCU ATM?

You can find your nearest RBFCU branch or ATM at rbfcu.org/locations. To find an RBFCU branch or ATM using the RBFCU Mobile app, tap the blue plus sign in the bottom menu, and choose “Contact Us” to view options, including “Locate a Branch or ATM.”

-

How do I connect my iPhone or Android to Wi-Fi?If you've enabled your device's settings to connect to networks automatically, you will get an RBFCU Wi-Fi pop-up. Select "Connect to Free Wi-Fi" to continue and connect.

If your device is not enabled to connect to networks automatically, navigate to your Wi-Fi settings and select the RBFCU Wi-Fi network. -

How do I pay for a safe deposit box?

The fee is automatically deducted annually from the account designated on your contract. A notice is also mailed to you as a reminder when it is time to renew.

-

How do I sign in to RBFCU Wi-Fi?

- Open Settings on your device

- From Settings > Wi-Fi, select RBFCU Wi-Fi

- Click "Connect to Free Wi-Fi"

If you're having trouble connecting to the Wi-Fi, please ask a branch employee for assistance. -

How long will I have access to Wi-Fi after connecting?You will have access to the Wi-Fi for two hours after connecting. Once the two hours have elapsed, you'll have to connect again to access Wi-Fi.

-

How much does it cost to use RBFCU Wi-Fi?Use of the Wi-Fi is free for members and visitors.

-

I need a debit or credit card today. Can I get a card made at an RBFCU branch?

No, RBFCU branches cannot make debit or credit cards. However, you can request a card at any RBFCU branch, and it will be mailed to your physical address on file, typically within three to five business days.

Although you may have to wait to receive a physical card, RBFCU offers instant digital access to your debit or credit card information through your Online Banking account or the RBFCU Mobile app. Choose “Manage Cards” from the menu, select your card, and then select “View Card Details.”

-

Is the safe deposit box vault fire/water/theft proof?

Our vault is fire, water and theft resistant. Every effort is made to ensure that our vault is safe and secure.

-

Is there a fee to use the Coinstar coin processing machine at my branch?

Yes. A coin processing fee is assessed on the value of all loose coins presented to RBFCU for deposit, payment or exchange. Rolled coins will not be accepted. This fee is 5% of the coins value for members, and 8% of the coins value for non-members.

-

What are the days and hours Wi-Fi will be accessible?RBFCU Wi-Fi is available Monday – Friday from 7 a.m. to 7 p.m. and Saturday from 7 a.m. to 5 p.m.

-

What are the terms and conditions for using Wi-Fi service?The full terms and conditions regarding our use of our Wi-Fi service can be found here.

-

What form of identification is accepted?

RBFCU accepts the following forms of identification: United States Driver’s License, U.S. state ID card (issued by the DMV), military ID, passport with photo (in English), passport card (with an additional form of ID), U.S. civil service card, Concealed Handgun License (Texas) same as A License to Carry (Texas).

If you are a non-U.S. person, we accept all forms previously listed as well as: Permanent Resident Card, Matricula Card (i.e., Mexico, Guatemala, Bolivia), U.S. Employment Authorization Card.

-

What if I no longer want my safe deposit box?

If you would like to move to a smaller safe deposit box or close your safe deposit box, please visit the branch where your safe deposit box is located and a Member Service Representative will assist you.

-

What items can be stored in a safe deposit box?

Many people store items of importance and value such as U.S. savings bonds, important documents and jewelry. Please note: Cash, explosives, corrosive, illegal and perishable items are strictly prohibited. Our contract lists items that are permissible for storage in a safe deposit box. Please reference your contract for details.

-

What transactions require my ID?

You must present a photo ID when making cash or check deposits, withdrawals, loan or credit card payments, Mastercard Cash Advances, currency exchanges*, check cashing, requesting cash back on a deposit, requesting a cashier’s check or money order and receiving information about your account.

*RBFCU does not exchange foreign currency.

-

When can I access my safe deposit box?

You can access your safe deposit box during lobby hours.

-

Who may access my safe deposit box?

Sole Renter: No additional access is to be given to anyone other than the Sole Renter.

Multiple Renters: Have equal access rights. In the event that either Renter passes away, access remains the same for the remaining Renter(s).

For the above roles, a Power of Attorney that specifies safe deposit box access will be honored. At the time of above Renter’s death, the Power of Attorney is null and void.

For the above roles, an Executor/Executrix presenting Letters of Testamentary will be granted full access as a representative of the decedent. Executor/Executrix and Renters above are to be allowed equal access without notification to the other.

Deputy: Appointed by the Owner/Renter to serve as the renter’s agent. In the event that either Owner/Renter passes away, access is no longer valid for the Deputy.

-

Why am I being asked for my ID on all transactions?

In order to protect you and your account, RBFCU must identify the transacting person on an account each time a transaction is made.

-

Why did my safe deposit box fee increase?

RBFCU considers a number of factors when determining changes to fees, including market conditions and inflation. RBFCU strives to provide members with the lowest fees in the industry and hopes to continue to achieve that with minimal fee increases.

-

Why is my ID required?

For all transactions, RBFCU needs to be able to identify any person with whom we are conducting business. We retain the ID in our system to identify the transacting person for researching transactions, should questions arise, and to protect our members against potential fraud.

-

Why isn’t my safe deposit box number on my key?

Your box number is not included as a security measure in the event your key is lost or stolen.

-

Will tellers at my branch accept rolled coins?

No, all coins must be counted by the Coinstar coin processing machines. Coins must be loose when added to the machine for counting. Rolled coins will not be accepted.

-

Do the Coinstar coin processing machines at my branch accept rolled coins?

No, the Coinstar machines do not accept rolled coins. Coins must be loose when added to the machine for counting.

-

Is there a fee to use the Coinstar coin processing machine at my branch?

Yes. A coin processing fee is assessed on the value of all loose coins presented to RBFCU for deposit, payment or exchange. Rolled coins will not be accepted. This fee is 5% of the coins value for members, and 8% of the coins value for non-members.

-

Will tellers at my branch accept rolled coins?

No, all coins must be counted by the Coinstar coin processing machines. Coins must be loose when added to the machine for counting. Rolled coins will not be accepted.

-

How do I connect my iPhone or Android to Wi-Fi?If you've enabled your device's settings to connect to networks automatically, you will get an RBFCU Wi-Fi pop-up. Select "Connect to Free Wi-Fi" to continue and connect.

If your device is not enabled to connect to networks automatically, navigate to your Wi-Fi settings and select the RBFCU Wi-Fi network. -

How do I sign in to RBFCU Wi-Fi?

- Open Settings on your device

- From Settings > Wi-Fi, select RBFCU Wi-Fi

- Click "Connect to Free Wi-Fi"

If you're having trouble connecting to the Wi-Fi, please ask a branch employee for assistance. -

How long will I have access to Wi-Fi after connecting?You will have access to the Wi-Fi for two hours after connecting. Once the two hours have elapsed, you'll have to connect again to access Wi-Fi.

-

How much does it cost to use RBFCU Wi-Fi?Use of the Wi-Fi is free for members and visitors.

-

What are the days and hours Wi-Fi will be accessible?RBFCU Wi-Fi is available Monday – Friday from 7 a.m. to 7 p.m. and Saturday from 7 a.m. to 5 p.m.

-

What are the terms and conditions for using Wi-Fi service?The full terms and conditions regarding our use of our Wi-Fi service can be found here.

-

Can I use Samsung Pay at the ATM to withdraw money?

No. Samsung Pay cannot be used at the ATM or at any payment terminal that requires you to insert your card into the reader (e.g. gas stations, vending machines, etc.).

-

How can I find an RBFCU ATM?

You can find your nearest RBFCU branch or ATM at rbfcu.org/locations. To find an RBFCU branch or ATM using the RBFCU Mobile app, tap the blue plus sign in the bottom menu, and choose “Contact Us” to view options, including “Locate a Branch or ATM.”

-

Are my safe deposit box contents insured?

No. Insurance is not provided by RBFCU or the National Credit Union Administration.

-

Do I need identification to access my safe deposit box?

Yes. To ensure privacy, we must verify your identification. Accepted forms of identification include: U.S. driver’s license; military ID; passport with photo (in English); Permanent Resident Card; or a matrícula consular.

-

How do I pay for a safe deposit box?

The fee is automatically deducted annually from the account designated on your contract. A notice is also mailed to you as a reminder when it is time to renew.

-

Is the safe deposit box vault fire/water/theft proof?

Our vault is fire, water and theft resistant. Every effort is made to ensure that our vault is safe and secure.

-

What if I no longer want my safe deposit box?

If you would like to move to a smaller safe deposit box or close your safe deposit box, please visit the branch where your safe deposit box is located and a Member Service Representative will assist you.

-

What items can be stored in a safe deposit box?

Many people store items of importance and value such as U.S. savings bonds, important documents and jewelry. Please note: Cash, explosives, corrosive, illegal and perishable items are strictly prohibited. Our contract lists items that are permissible for storage in a safe deposit box. Please reference your contract for details.

-

When can I access my safe deposit box?

You can access your safe deposit box during lobby hours.

-

Who may access my safe deposit box?

Sole Renter: No additional access is to be given to anyone other than the Sole Renter.

Multiple Renters: Have equal access rights. In the event that either Renter passes away, access remains the same for the remaining Renter(s).

For the above roles, a Power of Attorney that specifies safe deposit box access will be honored. At the time of above Renter’s death, the Power of Attorney is null and void.

For the above roles, an Executor/Executrix presenting Letters of Testamentary will be granted full access as a representative of the decedent. Executor/Executrix and Renters above are to be allowed equal access without notification to the other.

Deputy: Appointed by the Owner/Renter to serve as the renter’s agent. In the event that either Owner/Renter passes away, access is no longer valid for the Deputy.

-

Why did my safe deposit box fee increase?

RBFCU considers a number of factors when determining changes to fees, including market conditions and inflation. RBFCU strives to provide members with the lowest fees in the industry and hopes to continue to achieve that with minimal fee increases.

-

Why isn’t my safe deposit box number on my key?

Your box number is not included as a security measure in the event your key is lost or stolen.

-

What form of identification is accepted?

RBFCU accepts the following forms of identification: United States Driver’s License, U.S. state ID card (issued by the DMV), military ID, passport with photo (in English), passport card (with an additional form of ID), U.S. civil service card, Concealed Handgun License (Texas) same as A License to Carry (Texas).

If you are a non-U.S. person, we accept all forms previously listed as well as: Permanent Resident Card, Matricula Card (i.e., Mexico, Guatemala, Bolivia), U.S. Employment Authorization Card.

-

What transactions require my ID?

You must present a photo ID when making cash or check deposits, withdrawals, loan or credit card payments, Mastercard Cash Advances, currency exchanges*, check cashing, requesting cash back on a deposit, requesting a cashier’s check or money order and receiving information about your account.

*RBFCU does not exchange foreign currency.

-

Why am I being asked for my ID on all transactions?

In order to protect you and your account, RBFCU must identify the transacting person on an account each time a transaction is made.

-

Why is my ID required?

For all transactions, RBFCU needs to be able to identify any person with whom we are conducting business. We retain the ID in our system to identify the transacting person for researching transactions, should questions arise, and to protect our members against potential fraud.

-

Can I change my username, password, or security questions and answers from the RBFCU Mobile app?

Yes. To change these security settings:

- Sign in to the RBFCU Mobile app.

- Tap the profile icon in the top-right corner of the screen.

- Tap “Profile Settings.”

- Tap “Security Center.”

- Select “Username,” “Password,” or “Security Questions and Answers” and follow the prompts to change the setting.

-

Can I opt out of sign-in Alerts for my Online Banking account?

No. Sign-in Alerts are mandatory security Alerts that cannot be disabled.

-

Can I opt out of transfer Alerts for my Online Banking account?

No. Transfer Alerts are mandatory security Alerts that cannot be disabled.

-

Can I reset my username or password from the RBFCU Mobile app?

Yes. Open the RBFCU Mobile app on your phone, and tap “Having Trouble Signing In?” Follow the prompts to reset your username or password.

-

Do I have to use MFA with my Online Banking account?

No. If you’re more comfortable using RBFCU’s other options — OTP via text message or phone call, and security questions and answers — you’re free to keep using them. However, MFA is a much stronger security option to protect your account and very difficult for fraudsters to infiltrate.

-

How can I report a fraudulent RBFCU email?

If you receive an unsolicited email that appears to be from RBFCU, do not respond, do not click any links and do not open any attachments. Forward the email to abuse@rbfcu.org, then delete it.

-

How can I report a fraudulent RBFCU phone call?

If you receive an unsolicited phone call that appears to be from RBFCU, or the person claims to be an RBFCU representative, do not provide or confirm any personal information and hang up.

Contact RBFCU to verify if the phone call was legitimate or not, and report it.

-

How can I report a fraudulent RBFCU text message?

If you receive an unsolicited text message that appears to be from RBFCU, do not respond or click any links. Send a screenshot of the text message to abuse@rbfcu.org, then delete it.

-

How can I review my trusted devices in Online Banking?

Visit the My Devices page in your Online Banking account to review your trusted devices.

To review your trusted devices in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Profile Settings.”

- Select “Security Center.”

- Select “My Devices” to see a list of devices with access to your account.

-

How do I disable MFA with an authenticator app?

To disable MFA, please sign in to your Online Banking account to chat with a Member Service Representative. You can also call us at 210-945-3300 or visit your nearest branch. If you disable MFA, your Online Banking account will revert to the security option — OTP, or security question and answer — you previously had in place.

-

How do I dispute a transaction or report fraud on my credit card?

You may dispute and/or report fraud on a transaction through your Online Banking account, RBFCU Mobile app or by calling 210-945-3300.

-

How do I enable a lock screen on my device?

To enable a lock screen on your device,

- Open Settings on your device, and set a passcode, finger-swipe pattern, face or fingerprint that will be used to access your device when it’s locked.

- Restart your device.

- When your device restarts, you’ll be prompted to put in your new authentication to unlock it.

If you need further assistance enabling a lock screen on your device, click here for Apple® instructions and click here for Android™ instructions.

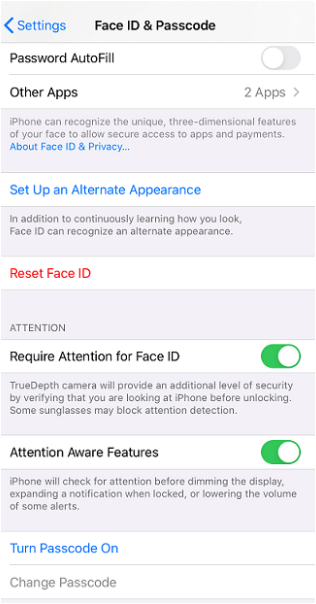

Where to set up a lock screen on an Apple device:

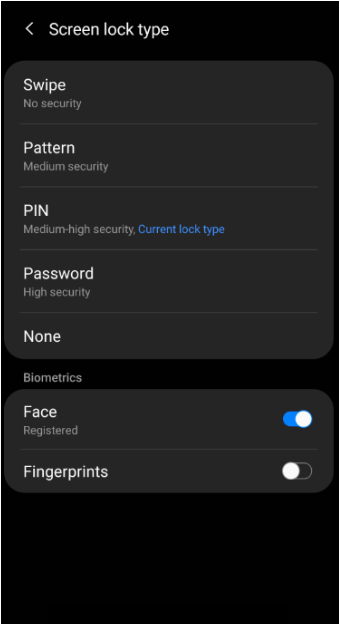

Where to set up a lock screen on an Android device:

-

How do I know it's RBFCU asking me to authorize a transfer attempt and not a fraudster?

RBFCU will only ask you to reply YES or NO to authorize a transfer. You should only authorize transfers that you are trying to make. If you’re not trying to make a transfer, or don’t recognize the transfer attempt, reply NO and take action to secure your Online Banking account.

Remember: RBFCU employees will never ask you to provide or verify your username, password, security questions and answers, multifactor authentication (MFA) codes, MFA recovery codes or one-time passcodes (OTP) — not via text message, not via push notification, not ever. Also, an RBFCU employee will never contact you to ask you to respond to a text message to authorize a transfer. If someone contacts you claiming to be an RBFCU employee and asks you to approve a transfer request for them, do not respond.

-

How do I know it's RBFCU asking me to verify a sign-in attempt and not a fraudster?

RBFCU will only ask you to allow or deny access to an unrecognized device when it attempts to sign in to your Online Banking account via push notification, text message or email. You should only allow devices to access your Online Banking account if you personally own and use them.

Remember: RBFCU employees will never ask you to provide or verify your username, password, security questions and answers, multifactor authentication (MFA) codes, MFA recovery codes or one-time passcodes (OTP) — not via push notification, not via text message, not ever. Also, an RBFCU employee will never need to sign in to your Online Banking account on your behalf. If someone contacts you claiming to be an RBFCU employee and asks you to approve a sign-in request for them, do not respond.

-

How do I remove a trusted device from my Online Banking account?

Visit the My Devices page in your Online Banking account to remove a trusted device.

To remove a trusted device in the RBFCU Mobile app:

- Sign in to the app.

- Select the profile icon in the upper-right corner.

- Select “Profile Settings.”

- Select “Security Center.”

- Select “My Devices.”

- Select “Deactivate” under the device you want to remove, and follow the prompts.

You may also deactivate a device from the device’s History page.

-

How do I set up fingerprint or face recognition on my device?

To turn on face and fingerprint (biometric) options on your device, open the “Settings” app, and follow the instructions provided with your device. To enable biometrics options, you’ll also need to set up a passcode lock, if you haven’t already. For additional help enabling biometrics, choose your option/device below:

After you’ve enabled biometrics:

- Open the RBFCU Mobile app®.

- Enter your username and password.

- Enable “Remember Me” by tapping the toggle switch under the “Password” field.

- Tap the “Sign In” button.

Once you enable Remember Me within the app, you will be prompted to sign in with your username and password at least once to verify. Your username and password will be captured, and you can sign in using a biometric option starting next time you sign in.

-

How do I set up MFA with an authenticator app for my Online Banking account?

To enable MFA for your account, sign in to your Online Banking account and visit the Multifactor Authentication page, or sign in to the RBFCU Mobile app.

- After you sign in, select the profile icon

- Select “Profile Settings”

- Select “Security Center”

- Select “Multifactor Authentication (MFA)”

- Under the “Authenticator App” section, select “Set Up Multifactor Authentication”

- You will be prompted for an OTP via text message or phone call to verify your identity. Select an option, then enter the code

- If you haven’t downloaded an authenticator app, you’ll be prompted to choose between Microsoft Authenticator and Google Authenticator. If you’ve already downloaded an authenticator app, select “Next” to skip this step

- On your device, add a new account in your authenticator app

- Then, scan the provided QR code or copy the 32-digit written code from your Online Banking account to verify your account in the authenticator app

- Enter the 6-digit code generated by the authenticator app in Online Banking, select “Enroll” to complete the setup and finally select “Submit”

- You’re done! You’ll receive a text message and/or email Alert to confirm your enrollment. On the success screen, you’ll be given a 16-digit recovery code. Save this code in a secure location so you’ll still be able to sign in to your Online Banking account in the event you lose access to the authenticator app — for example, if your device is lost, damaged or stolen

After enabling MFA, you can choose to be prompted for a 6-digit MFA code every time you sign in to your Online Banking account. This is optional — but highly recommended — since MFA greatly strengthens your account’s security. To manage this option, visit the MFA page in your Online Banking account.

Remember: RBFCU and RBFCU employees will never initiate a phone call, email or text message asking you to provide your authenticator code or recovery code. Do not provide these codes to anyone.

-

How do I set up sign-in Alerts for my Online Banking account?

Sign-in Alerts are a security feature that’s automatically included with Online Banking. No action is required on your part to enable sign-in Alerts.

However, there are some settings you can review to ensure RBFCU is able to deliver sign-in Alerts to you:

- Update the RBFCU Mobile app to the latest version: Visit rbfcu.org/update from your device to go to your app store. If you see an “Update” button, tap it to install the latest version of the app.

- Turn on push notifications for the RBFCU Mobile app on your device:

- For Apple users:

- From the Home screen, open the Settings app on your device.

- Scroll down to the list of apps at the bottom, and choose the RBFCU Mobile app (listed as “RBFCU”).

- Tap “Notifications.”

- Toggle “Allow Notifications” to on and set your preferences.

- For Android users:

- From the Home screen, swipe up to access “All Apps.”

- Find and open the Settings app.

- Tap “Apps.”

- Choose the RBFCU Mobile app (listed as “RBFCU”) from the list.

- Tap “Notifications.”

- Toggle “Show Notifications” to on and set your preferences.

- For Apple users:

- Opt-in to text messages: You may have opted out of text messages from RBFCU at some point. To opt in to RBFCU text messages, text START to 968772 and 839872. You’ll receive a confirmation letting you know you’ve successfully subscribed to RBFCU text messages.

- Verify we have your current mobile phone number and email address: You can do this in your Online Banking account or in the RBFCU Mobile app:

- Sign in and select the profile icon in the top-right corner.

- Select “Profile Settings.”

- Select “Contact Settings,” and follow the prompts to update your email address, phone number or mailing address.

-

How do I set up transfer Alerts for my Online Banking account?

Transfer Alerts are a security feature that are automatically included with Online Banking. No action is required on your part to enable transfer Alerts.

However, there are some settings you can review to ensure RBFCU is able to deliver transfer Alerts to you:

- Opt-in to text messages: You may have opted out of text messages from RBFCU at some point. To opt in to RBFCU text messages, text START to 968772 and 839872. You’ll receive a confirmation letting you know you’ve successfully subscribed to RBFCU text messages.

- Verify we have your current mobile phone number: You can do this in your Online Banking account or in the RBFCU Mobile app:

- Sign in and select the profile icon in the top-right corner.

- Select “Profile Settings.”

- Select “Contact Settings,” and follow the prompts to update your email address, phone number or mailing address.

-

How do I update my email address, phone number or mailing address with RBFCU?

You can update your contact information in your Online Banking account or in the RBFCU Mobile app:

- Sign in and select the profile icon in the top-right corner.

- Select “Profile Settings.”

- Select “Contact Settings,” and follow the prompts to update your email address, phone number or mailing address.