Navigating Tax Strategies for Retirement Savings

Planning for retirement involves not only accumulating savings but also understanding the tax implications of various investment vehicles. Tax-efficient strategies can significantly impact the growth and distribution of retirement assets.

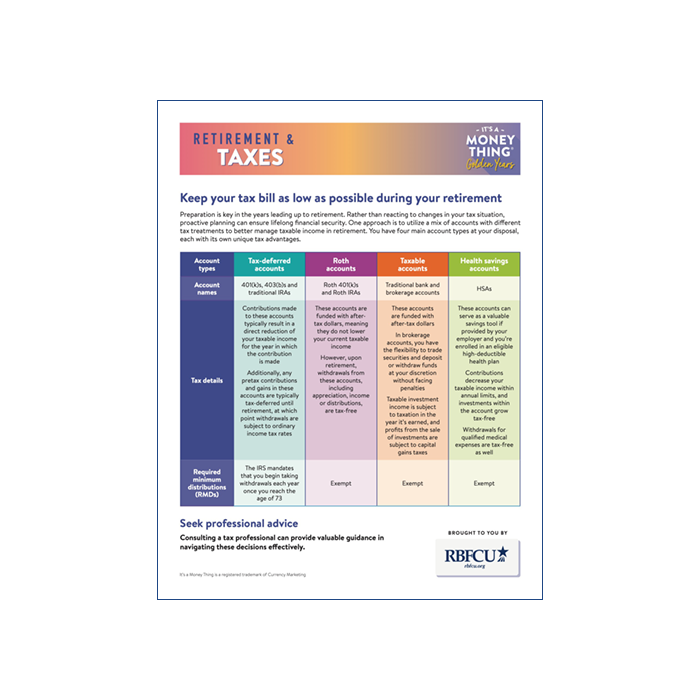

In this article, we explore key considerations for maximizing tax advantages when saving for retirement, including tax-deferred accounts, Roth accounts, taxable accounts and health savings accounts.

(Article continues below video)

Tax-Deferred Accounts

Traditional retirement accounts, such as 401(k)s, 403(b)s and traditional IRAs, offer tax-deferred growth.

Contributions to these accounts are typically made with pre-tax dollars, reducing your taxable income in the year of contribution. Earnings within the account grow tax-deferred until withdrawal during retirement, at which point they are taxed as ordinary income.

Tax-deferred accounts are advantageous for individuals who anticipate being in a lower tax bracket during retirement.

Key points:

- Maximize contributions: Contribute the maximum allowable amount to tax-deferred accounts each year to take full advantage of tax-deferred growth.

- Consider rollovers: Consolidate multiple retirement accounts into a single tax-deferred account to simplify management and potentially reduce fees.

- Required minimum distributions (RMDs): Be aware of RMD rules, which require individuals to withdraw a minimum amount from tax-deferred accounts after reaching age 73.

Roth Accounts

Roth retirement accounts, such as Roth IRAs and Roth 401(k)s, offer tax-free growth.

Contributions to Roth accounts are made with after-tax dollars, meaning withdrawals during retirement are tax-free, provided certain conditions are met.

Roth accounts are particularly beneficial for individuals who expect to be in a higher tax bracket during retirement or who desire tax diversification.

Key points:

- Consider conversion: Evaluate the option to convert traditional retirement account assets to Roth accounts, paying taxes on the converted amount upfront to enjoy tax-free growth in the future.

- Withdrawal flexibility: Unlike traditional retirement accounts, Roth IRAs do not have RMDs during the account holder’s lifetime, offering more flexibility in managing withdrawals.

- Estate planning: Roth accounts can be valuable estate planning tools, as heirs inherit them tax-free, potentially allowing for multigenerational tax-free growth.

Taxable Accounts

Taxable brokerage accounts offer flexibility and liquidity but lack the tax advantages of retirement accounts.

While investments in taxable accounts are subject to capital gains tax upon sale, they provide greater accessibility and fewer restrictions on withdrawals.

Taxable accounts can complement tax-advantaged retirement savings by providing additional income during retirement and serving as a source of emergency funds.

Key points:

- Tax-efficient investing: Optimize investment strategies within taxable accounts by prioritizing tax-efficient investments, such as index funds and tax-exempt municipal bonds.

- Capital gains management: Implement tax-loss harvesting and strategic asset location strategies to minimize capital gains taxes within taxable accounts.

- Long-term perspective: Take advantage of favorable long-term capital gains tax rates by holding investments in taxable accounts for more than one year.

Health Savings Accounts

Health Savings Accounts (HSAs) offer triple tax advantages for qualified medical expenses.

Contributions to HSAs are tax-deductible, earnings grow tax-free and withdrawals for qualified medical expenses are tax-free.

HSAs can serve as a valuable retirement savings vehicle, providing an additional source of tax-free income during retirement, especially when paired with high-deductible health plans (HDHPs).

Key points:

- Maximize contributions: Contribute the maximum allowable amount to HSAs each year and consider investing HSA funds for long-term growth.

- Retirement savings: Use HSAs as a supplemental retirement savings tool by covering current medical expenses out of pocket and allowing HSA funds to grow tax-free for future medical expenses or retirement income.

- Medicare premiums: HSA funds can be used tax-free to pay for Medicare premiums after reaching age 65, providing additional tax benefits in retirement.

Effective retirement planning involves optimizing tax strategies to maximize savings and minimize tax liabilities. By understanding the tax advantages of various retirement accounts, including tax-deferred accounts, Roth accounts, taxable accounts and HSAs, you can make informed decisions to build a tax-efficient retirement portfolio tailored to your unique financial goals and circumstances. Consulting with a financial advisor or tax professional can provide personalized guidance and ensure compliance with tax laws and regulations.