Credit Union Myths: What Does It Mean to Be a Credit Union Member?

Even though there are over 5,000 credit unions in the United States, many misconceptions about their structure and their services still exist.

One popular-but-false assumption is that the term “credit union member” is interchangeable with the term “credit union customer.”

It might seem like a harmless mistake, but the concept of membership is what sets credit unions apart from other financial institutions. A “member” isn’t an empty marketing term — it reflects your credit union’s commitment to co-operative values and shapes your entire banking experience.

As a member, you’re a part owner, you have a say in how your credit union is run and you get to share in its success in tangible ways.

(Article continues below video)

You own a part of your credit union

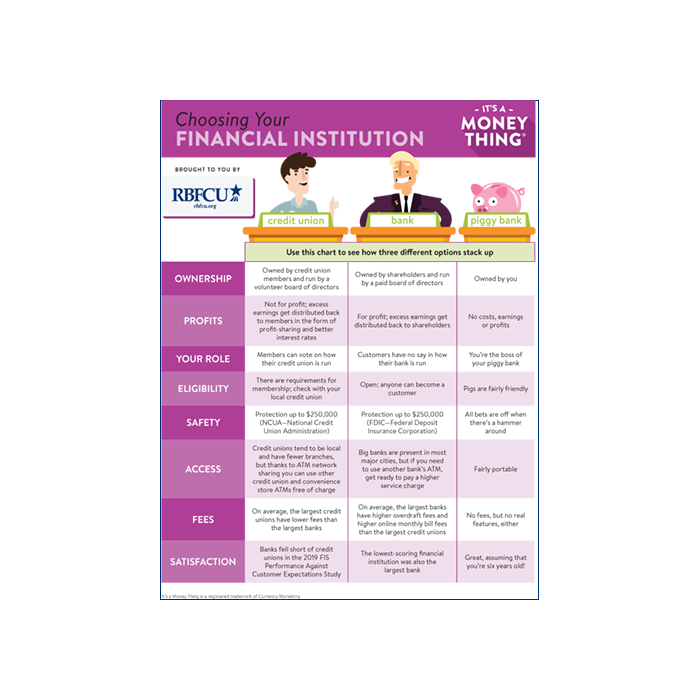

The main difference between banks and credit unions is their ownership: Banks are owned by investors and credit unions are member-owned (this makes them financial co-operatives).

When you first open an account at a credit union, you make a small deposit. The initial deposit isn’t some sort of service fee — it buys you a common share in your credit union.

As a shareholder, you officially own a part of your credit union, which gives you access to the benefits listed below.

You affect how your credit union is run

Members are directly involved in shaping their credit union’s future (bank customers, for the record, have no say).

As a member, you get to vote on your credit union’s board of directors (or even run for the board yourself).

You also have the opportunity to vote on special resolutions or key policy decisions at annual general meetings. Partnerships with local charities and small businesses also provide plenty of opportunity to contribute to initiatives in your community.

You share in your credit union’s success

When your credit union profits, so do you. As a shareholder, you benefit from your credit union’s success in the form of lower fees, better interest rates or cash back.

That shared success goes both ways, which means that your credit union is invested in your financial well-being, as well. This translates into helpful financial coaching, sincere advice and top-notch customer service. This might help explain why credit unions consistently rate highly in the American Customer Satisfaction Index.

As financial co-operatives, credit unions are structured in such a way that they prosper with their members.

Being a credit union member means you share your financial institution’s ownership, vision and profits. It gives you the opportunity to shape your personal banking experience, as well as the impact your banking has on your local community.

Membership has meaning and value. It’s not equivalent to being a customer at another financial institution — it’s a complete alternative.