All About Credit Scores: 3 Important Questions Answered

Here are the answers to three important questions about credit scores: What is a credit score?, Why do I have a credit score?, and How is my credit score calculated?

What is a credit score?

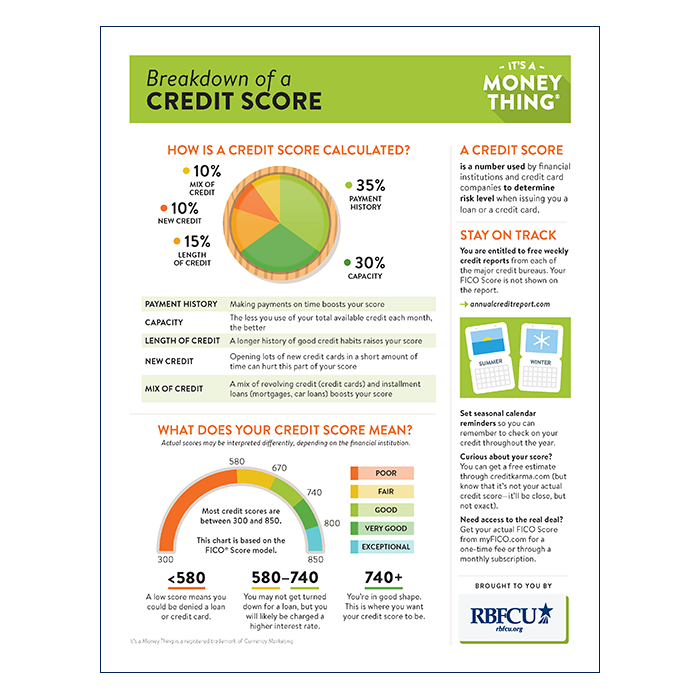

A credit score is a three-digit number between 300 and 850 that’s calculated by credit bureaus. The higher your score, the better you look to potential lenders. Basically, a credit score rates your creditworthiness. It’s all based on the info in your credit report.

Why do I have a credit score?

Your credit score helps predict the likelihood of you making on-time payments. Your credit report contains info on your use of credit over time, and that info gets fed through a scoring model that calculates your credit score. This standardized system helps lenders and landlords assess risk more easily. If you keep your score up, it can give you more options and save you a ton of money!

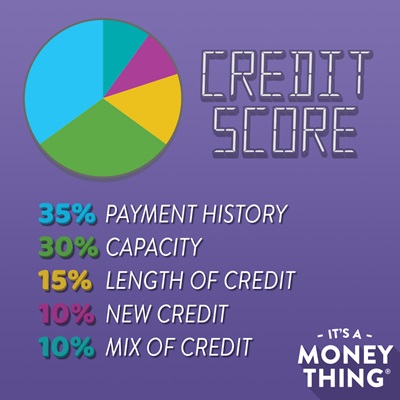

How is my credit score calculated?

Your credit score is calculated based on your history of on-time payments, how much of your credit capacity you use, how long you’ve had a credit history, how many new credit accounts you open and the variety of different types of credit that you use.