Let’s Count the Ways to Save: Money Market Accounts

When people hear the words “money market,” the first things that might come to mind are Wall Street, investments, and complicated, confusing rates. Don’t get money markets mixed up with any of that high-finance terminology. The truth is, money markets are an easy, straightforward and solid investment choice.

RBFCU makes saving easy, and that’s the case with money markets. The higher investment levels of money markets open up higher rates of return than a standard savings account yet none of the risks associated with stocks and bonds. Plus, money market returns are guaranteed.

Just like savings accounts and certificate accounts, money markets at RBFCU are federally insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor. Here are some features of money market accounts available at RBFCU:

- Options. RBFCU offers two money markets. Each require at least $2,500 to open and at least $2,500 must remain in the account for it to earn the money market rate (otherwise, it will convert to a standard savings account rate).

- The RBFCU Classic Money Market account offers a flat dividend rate based on your total balance.

- The RBFCU Choice Money Market account earns the stated dividend rate on the portion of the balance within each specified tier. It gives higher rates of return for lower levels of investment, and as your balance grows you can take advantage of blended rates to maximize your savings.

- Flexibility. A money market is more like a savings account in that you enjoy immediate access to your money.* It’s unlike a certificate account, which requires the investor to keep funds in the account for an agreed amount of time or pay possible penalties for early withdrawal.

DepositAccounts.com refers to money market accounts as a great risk-free option for beginning investors. Savings instruments like money market accounts also are a great place to put money when people are in between investments.

Saving is easy!

The Growth of Money in a Money Market Account

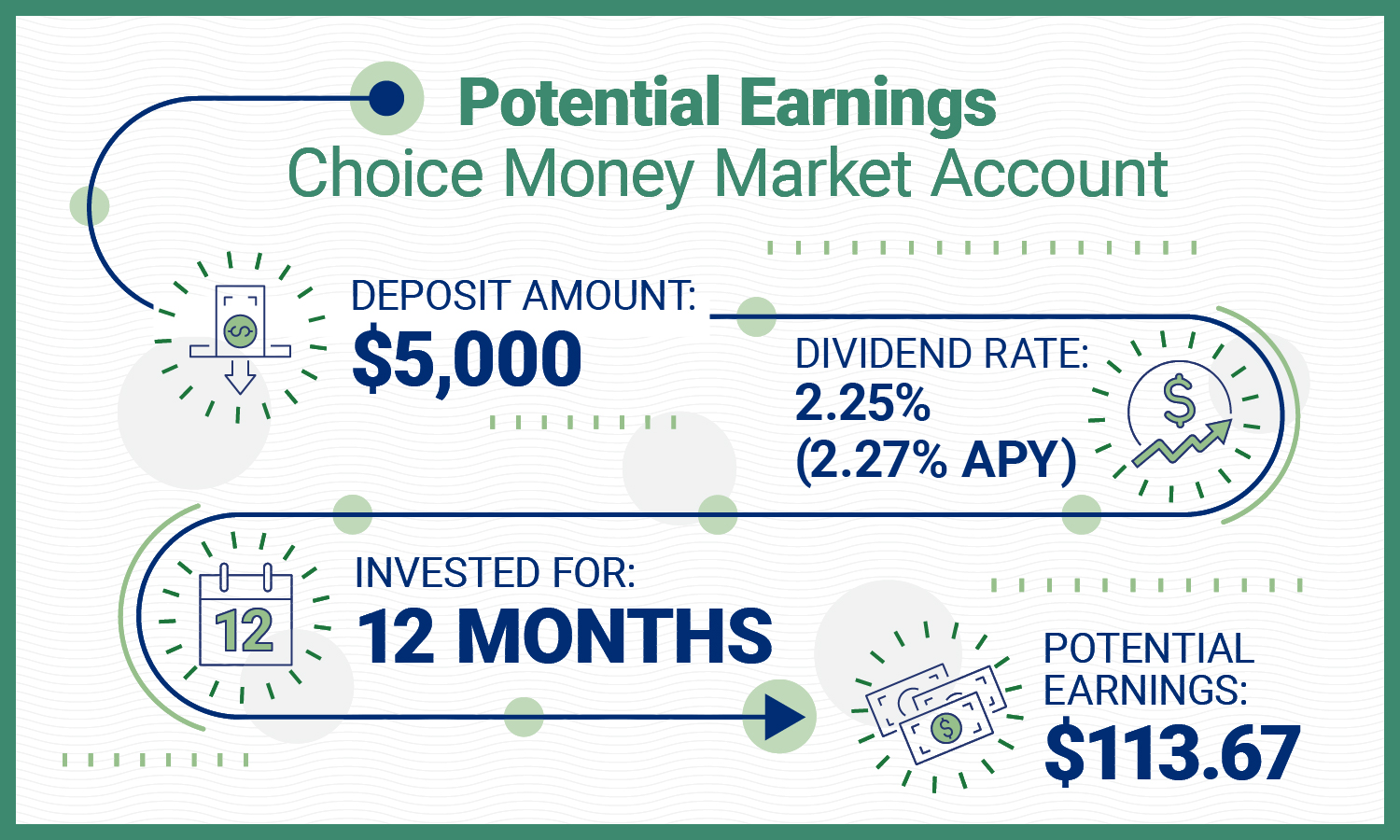

The first image shows an example of an RBFCU Choice Money Market account with $5,000 invested for 12 months with a dividend rate of 2.25%.

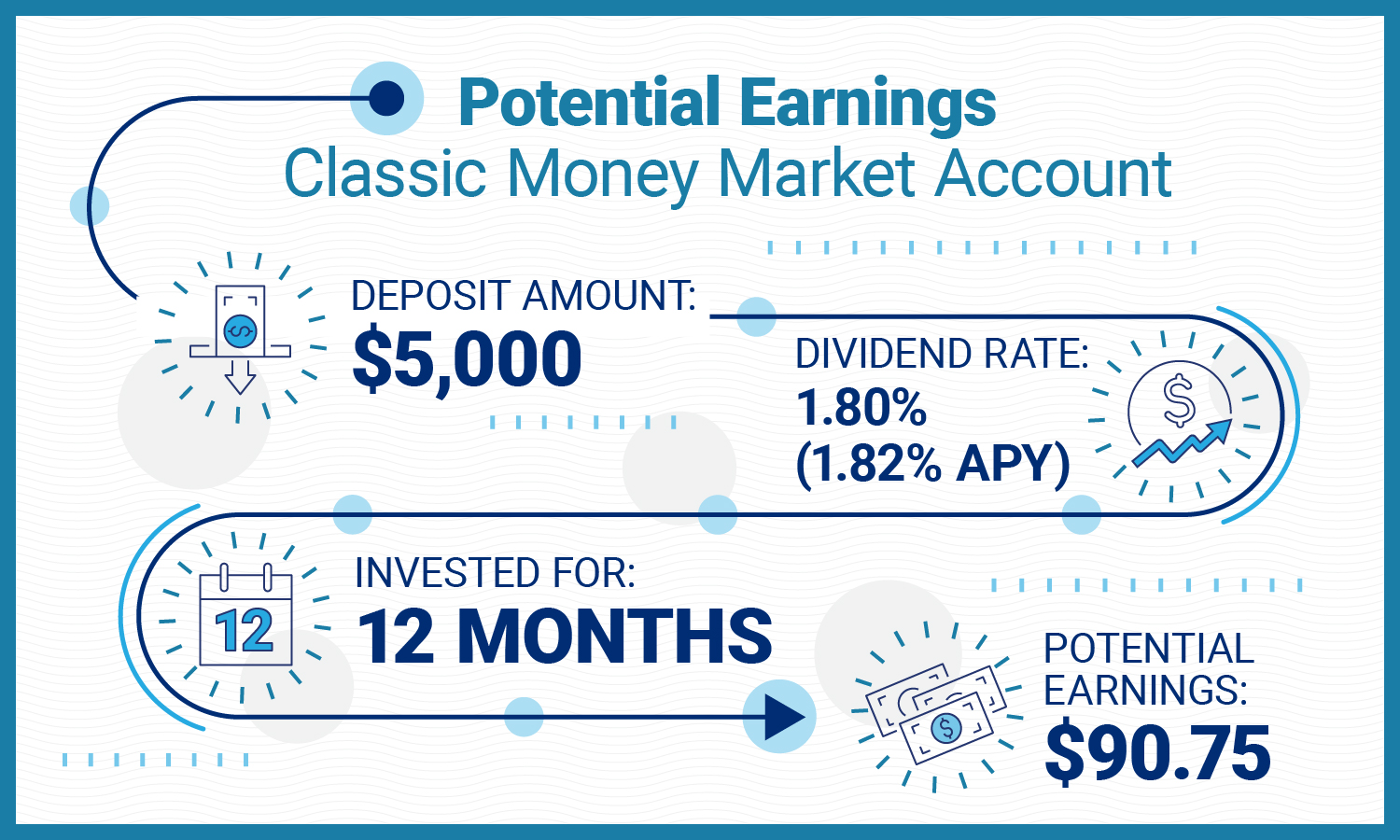

The second image shows an example of an RBFCU Classic Money Market account with $5,000 invested for 12 months with a dividend rate of 1.80%.