Using Credit Cards Responsibly: The 3 Things You Should Do Each Month

When you get your first credit card — or even just a new one — it’s tempting to go on a spending spree! But making responsible decisions when using your credit card will help to keep your credit score high and your total debt low. Here are the three things you should do each month to use your credit cards responsibly.

Pay in full and on time

The key to a successful relationship with your credit card is to pay it in full, and on time each month. Just making the minimum monthly payment can leave you saddled with debt after the interest adds up. Also, don’t forget to allow extra time for your payment to process!

Leave some room

A credit limit is the total amount of money that can be charged to a credit card, including purchases, interest charges and fees. Keep tabs on how much room you have, and never max out your cards. In order to build up a good credit history, you want to be using 30% or less of your total credit. Keeping your utilization rate low will also help prevent your credit card debt from piling up faster than you can pay it off.

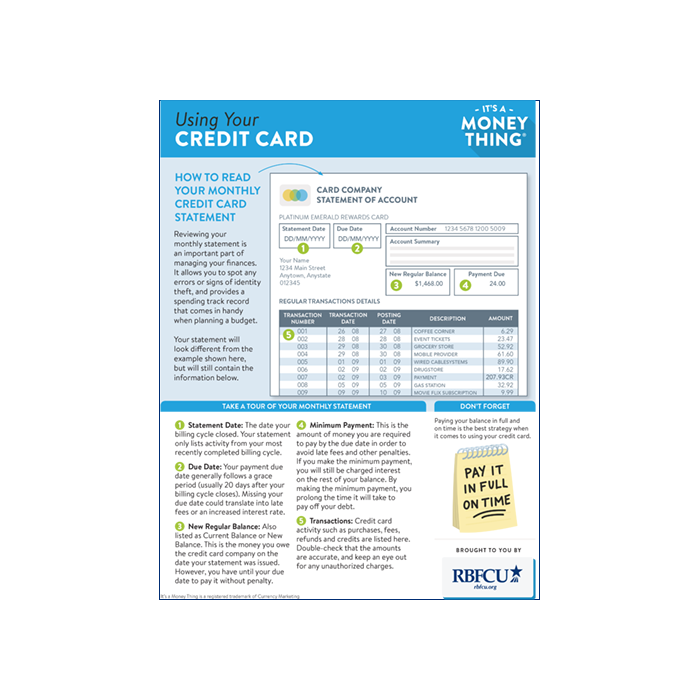

Review your statement

Do you give your monthly credit card statement a quick glance before filing (or throwing) it away? Your statement is a summary of how you've used your card for a billing period, and it's important to read it carefully to track your spending. By not paying close attention, you may be missing hidden costs, unauthorized or incorrect charges, and billing errors, digging you deeper into debt.