Financial Literacy Month: 5 Steps to Build Your Budget

April brings us reason to celebrate many things. Add the idea of Financial Literacy Month to the list, and keep it near the top. The U.S. Senate designated April as National Financial Literacy Month more than 10 years ago.

The best way to start to understand the importance finances play in your life is to sit down and make a budget. Financial professionals have told writers with U.S. News and World Report that budgets are really important because that's where you can uncover opportunities or problems, and budgets give you the data you need to take action.

Here are five steps to build your budget:

1. Review the past: Looking at your cash flow from the past year or the past few months can give you a good idea of what you can expect with future budgets. Dig into the details as deep as you can from your bank account and credit card statements. Load the data into special budgeting apps, create a spreadsheet, or even write it down on paper.

2. Predict the future: Look at a calendar and try to find birthdays, weddings, holidays or even planned medical procedures that go along with any other bills or expenses that pop up at random. You’ll need to save for those now.

3. Know your goals: You need to be able to juggle between paying for every-day expenses and financing your future. That could include something that comes up as quickly as a summertime vacation. It could be some sort of not-too-far-away goal of buying a house. You definitely need to think about setting aside money for retirement. You can create separate savings accounts for each goal.

4. Be able to adjust: With all the numbers down on paper, it might be easier to see where you can cut your spending in order to save more. You can spotlight the money you spend on discretionary items. Do you really need an unlimited data plan? Can you do without a fourth entertainment channel on your TV package? Leftovers don’t cost as much as eating out for lunch, and leaving a tip. Trimming from a number of categories, or eliminating a category all together, can add up to nice savings. Involve your family; work as a team.

5. Believe in change: So, you’ve gotten a nice tax refund the last few years? Is that going to happen again, or has something changed with your life (marital status, sale of a major asset, loss of a write-off)? Tax reform almost always is an issue, so it might be worth seeing a tax professional if those things do happen. You’ll have to account for it if you want an accurate budget that’s worth the time you’ve put into it.

Don’t know how to create a budget? We’ve found this link with plenty of budget templates.

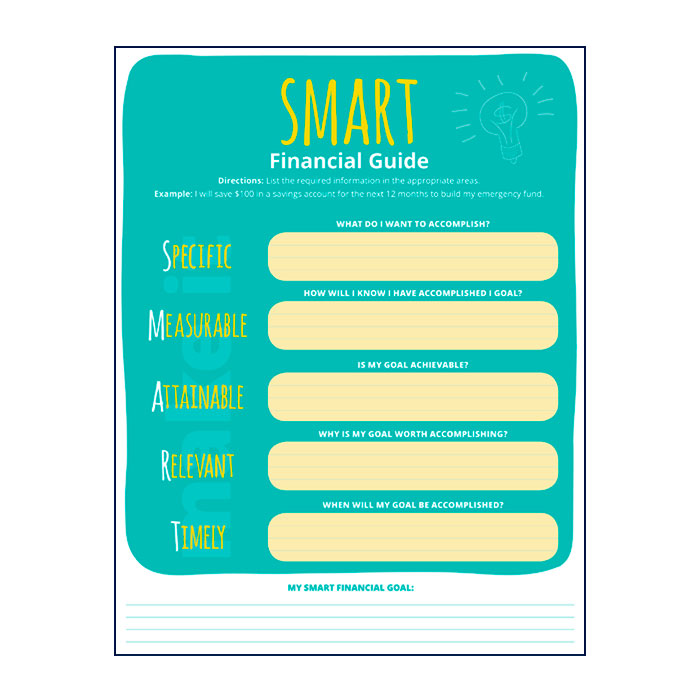

SMART Financial Goals Guide

No matter how big or small your savings goals may be, use this worksheet to help you determine and set realistic financial goals that make sense for your budget.

This information is intended to provide general information and should not be considered tax advice. Please consult a tax professional for more information.