Newsroom

Established in 1952, Randolph-Brooks Federal Credit Union is a full-service financial cooperative whose mission is to improve members’ economic well-being and quality of life.

For media inquiries, please contact our Media Relations Team at press@rbfcu.org.

Latest press releases

2024

- April 12, 2024 — Empowering Tomorrow’s Entrepreneurs: A Success Story by RBFCU’s Financial Literacy Team

- Feb. 27, 2024 — RBFCU Investments Group Welcomes Bryan M. Grove II, CFP®, CFS®, APMA™ as Financial Advisor

- Feb. 23, 2024 — RBFCU Announces New Leadership Appointments to Highlight Opening Months of 2024

- Feb. 5, 2024 — A Conversation with the Leaders of RBFCU Wealth Management, The Garner Davis Group

2023

- Nov. 30, 2023 — Mark Sekula Named Next President/Chief Executive Officer at RBFCU

- Sept. 26, 2023 — RBFCU Wealth Management Welcomes The Garner Davis Group

- July 10, 2023 — RBFCU Aims to Increase Awareness of Rising Text Message Scams

- May 26, 2023 — RBFCU Investments Group Welcomes Roger Torres, AAMS® as Financial Advisor

2022

- Nov. 17, 2022 — RBFCU Investments Group Expands Presence in Dallas-Fort Worth Region

- Oct. 24, 2022 — Randolph-Brooks Federal Credit Union Increases Starting Pay to $20 per Hour

- Aug. 31, 2022 — RBFCU's Berenice Villarreal Wins 2022 NAFCU Professional of the Year Award

- Aug. 5, 2022 — RBFCU Investments Group Welcomes Terence F. Powell, Jr., AIF® as Investment Program Manager

- July 22, 2022 — RBFCU Advising Community on Suspicious Texts, Phone Calls

- July 18, 2022 — RBFCU Investments Group Adds Three Financial Advisors to the Team

- July 8, 2022 — RBFCU’s Youth Ambassador Program Awards $9,750 in Scholarships to San Antonio-Area Students

- June 15, 2022 — Randolph-Brooks Federal Credit Union Emphasizes Credit Building Through Products and Financial Lessons

- March 24, 2022 — Cheryl Walston Promoted to Vice President-Controller at RBFCU

- March 9, 2022 — RBFCU Wins MemberXP 2022 Best of the Best Award

- March 4, 2022 — Zach Crews Promoted to Senior Vice President-Finance at RBFCU

- Feb. 25, 2022 — Bankrate Chooses RBFCU as a Top 10 Credit Union in the U.S.

- Feb. 11, 2022 — RBFCU Named as a Top Workplace USA

2021

- Dec. 7, 2021 — Children’s Miracle Network Benefits from RBFCU Involvement in Credit Unions For Kids

- Dec. 6, 2021 — RBFCU Opens South San Branch, Expands Footprint in San Antonio Area

- Nov. 18, 2021 — Member Giveback Sweepstakes Highlights RBFCU’s 70th Year

- Nov. 3, 2021 — Two Financial Advisors Join RBFCU Investments Group

- Oct. 27, 2021 — RBFCU Reaches 1 Million-Member Landmark

- Sept. 13, 2021 — Randolph-Brooks Federal Credit Union Increases Starting Pay to $18 per Hour

- Sept. 1, 2021 — Three Key Promotions Announced in RBFCU Business Solutions

- Aug. 6, 2021 — ‘Best Places to Work’ Awards RBFCU — Again — as No. 1

- July 12, 2021 — RBFCU Named No. 1 Credit Union in Texas

- June 16, 2021 — More Payments Coming from U.S. Government: What You Need to Know About Advance Child Tax Credit Payments

- June 9, 2021 — Ameriprise Financial Selected as Randolph-Brooks Federal Credit Union’s New Broker-Dealer

- June 7, 2021 — RBFCU in Central Texas Named ‘Best Places to Work’

- May 4, 2021 — Randolph-Brooks Federal Credit Union Switches To Coinstar Coin Counting

- April 6, 2021 — RBFCU Wins MemberXP 2021 Best of the Best Award

- April 2, 2021 — RBFCU Voted Best Credit Union

- March 11, 2021 — Stimulus Checks: What You Need to Know About the Government-Issued Relief Checks Through the American Rescue Plan Act

- Feb. 22, 2021 — RBFCU Operations Returning to Normal After Winter Weather

2020

- Dec. 31, 2020 — RBFCU Statement on Dec. 30, 2020 System Issues

- Oct. 14, 2020 — RBFCU Opens Doors to Portland

- Sept. 25, 2020 — Texas Air Force Association Honors RBFCU as Top Civilian Organization

- Sept. 17, 2020 — RBFCU Establishes Diversity Advisory Council, Selects 11 Employees to Serve

- Sept. 9, 2020 — RBFCU Surpasses a $1 Billion Landmark in Mortgages Funded

- Aug. 3, 2020 — RBFCU Announces Support of Credit Union Awareness

- July 24, 2020 — RBFCU Promotes Ashley Ingle to Senior Vice President of Human Resources/Learning & Development

- July 7, 2020 — RBFCU Employees Volunteer to Provide Emergency Housing Assistance

- June 10, 2020 — RBFCU Statement on Current Events

- May 15, 2020 — San Antonio Food Bank Awarded $5,000 Donation Through Liberty Mutual® and Safeco Insurance® Emergency Community Support Grants

- May 6, 2020 — RBFCU's Youth Ambassadors Program Awards $5,750 in Scholarships to San Antonio-Area Students

- April 20, 2020 — RBFCU Encourages Members to Use ‘Financial Distancing’ to Stamp Out the Spread of Fraud

- March 27, 2020 — RBFCU Remains a Trusted Financial Partner

- March 27, 2020 — Financial Fraud During the COVID-19 Outbreak

- Feb. 24, 2020 — RBFCU Surpasses $10 Billion in Assets

- Feb. 11, 2020 — RBFCU Partners with KSAT Community to Highlight Service Projects

- Feb. 3, 2020 — Munsterteiger Promoted to Enterprise Fraud VP Role

- Jan. 13, 2020 — RBFCU Chooses Raddon to Enable Next-Generation Marketing

- Jan. 10, 2020 — Phishing Alert: RBFCU Warns of Attempted Email Scams Targeting Members and Nonmembers

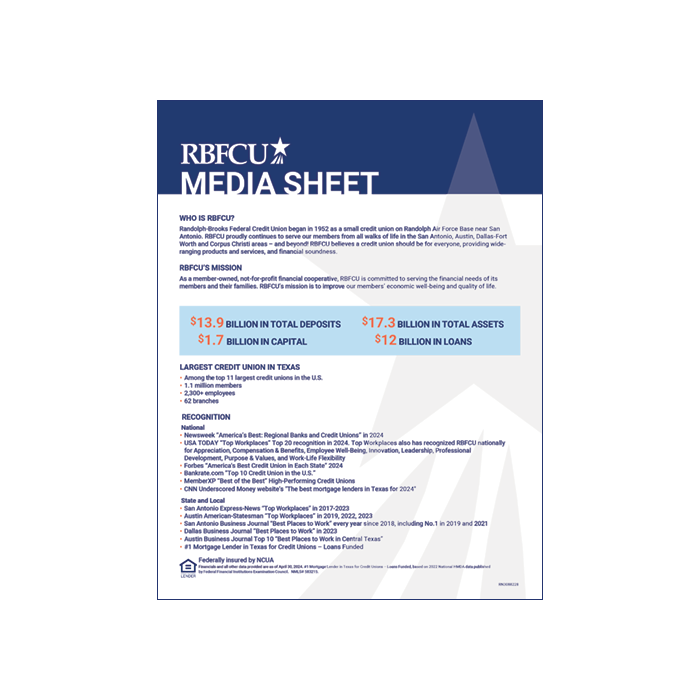

RBFCU Media Kit

We are proud to be the trusted financial partner for a growing membership. This RBFCU Media Kit gives a few facts and figures, and describes how the credit union became what it is today.

2023 Annual Report

In 2023, our focus was to remain steadfast to what our members have come to know us as: a stable financial institution that meets the growing needs of our members.

Member Magazine: Your Guide to RBFCU’s Products and Services

Throughout this magazine, you’ll find reasons why members do business with RBFCU. Read more to find out what RBFCU can do to help improve your economic well-being and quality of life.

Find all statement inserts under the “Statement Inserts” tab on the Forms & Disclosures page.

-

I am a reporter with a media inquiry. Who should I contact?

For media inquiries, please contact Salvador Guerrero, Vice President-Corporate Communications & Public Relations, at sguerrero@rbfcu.org or 210-637-4287.

-

When is RBFCU's annual meeting?

The annual meeting is scheduled for the end of March each year. Watch member communications for date, time and location details.

-

What is a credit union?

Credit unions are not-for-profit cooperatives, owned by their members who save and borrow there. We exist to serve our members, not to make a profit, so credit unions do not issue stock or pay dividends to outside stockholders. Instead, we return our earnings to members by providing lower loan rates, generally pay higher dividends on deposits and charge lower fees.

Credit unions are a democracy. Each credit union member has equal ownership and one vote, regardless of how much money they have on deposit.

Every credit union is governed by a board of directors, elected by and from the credit union's membership. Board members serve voluntarily and receive no compensation.

Credit unions cannot serve the general public; instead, people must qualify for membership. People are eligible for credit union membership through their employer or organizational affiliations like churches or social groups, or a community-chartered credit union.

Credit unions provide beneficial education to their members so they can become better educated consumers of financial services. We not only focus on our adult members, but work to give our youth and young adults the skills they need to become financially savvy.

-

How do I qualify for membership with RBFCU?

There are several ways to qualify for membership with RBFCU. Common ways to qualify for membership include your employer, place of worship, community organization, neighborhood or school. You may also qualify through immediate family members who are part of the credit union (spouse, children, parents, siblings, stepchildren, adopted relatives, etc.). You can complete a short online application to see if you qualify for membership.

If you are unable to qualify through any of the options listed above, you may contact us and our Member Service Specialists can help you determine if there are additional opportunities to qualify.

-

Why do I have to qualify for membership?

Unlike banks that are open to anyone, laws require credit unions like RBFCU to have a defined field of membership, which means you have to be a member to access the products and services credit unions provide. There are a variety of ways to qualify based on where you work, live, worship or attend school. When you become a member of RBFCU, you take advantage of lower loan rates, higher dividends on deposits and lower fees.